Democrats Attack Domestic Energy Producers Through “Build Back Better”

On November 19, the House of Representatives passed a $2 trillion budget bill with a long list of increases in federal royalties and fees, plus new fees, new taxes, and barriers to leasing in the Arctic National Wildlife Refuge, the Pacific, Atlantic, and eastern Gulf of Mexico. It passed on a party-line vote of 220-213 and was sent to the Senate, where changes are expected. It contains a long list of higher costs for oil and gas companies, especially those operating on federal lands. The arbitrary new fees would add millions of dollars in operating costs, pricing out U.S. production. This bill taxes American energy, restricts access to resources owned by Americans and advances ‘import-more-oil’ strategy that the Biden administration has been promoting—all of which will cost Americans more to heat their homes with natural gas and fill their tanks with gasoline.

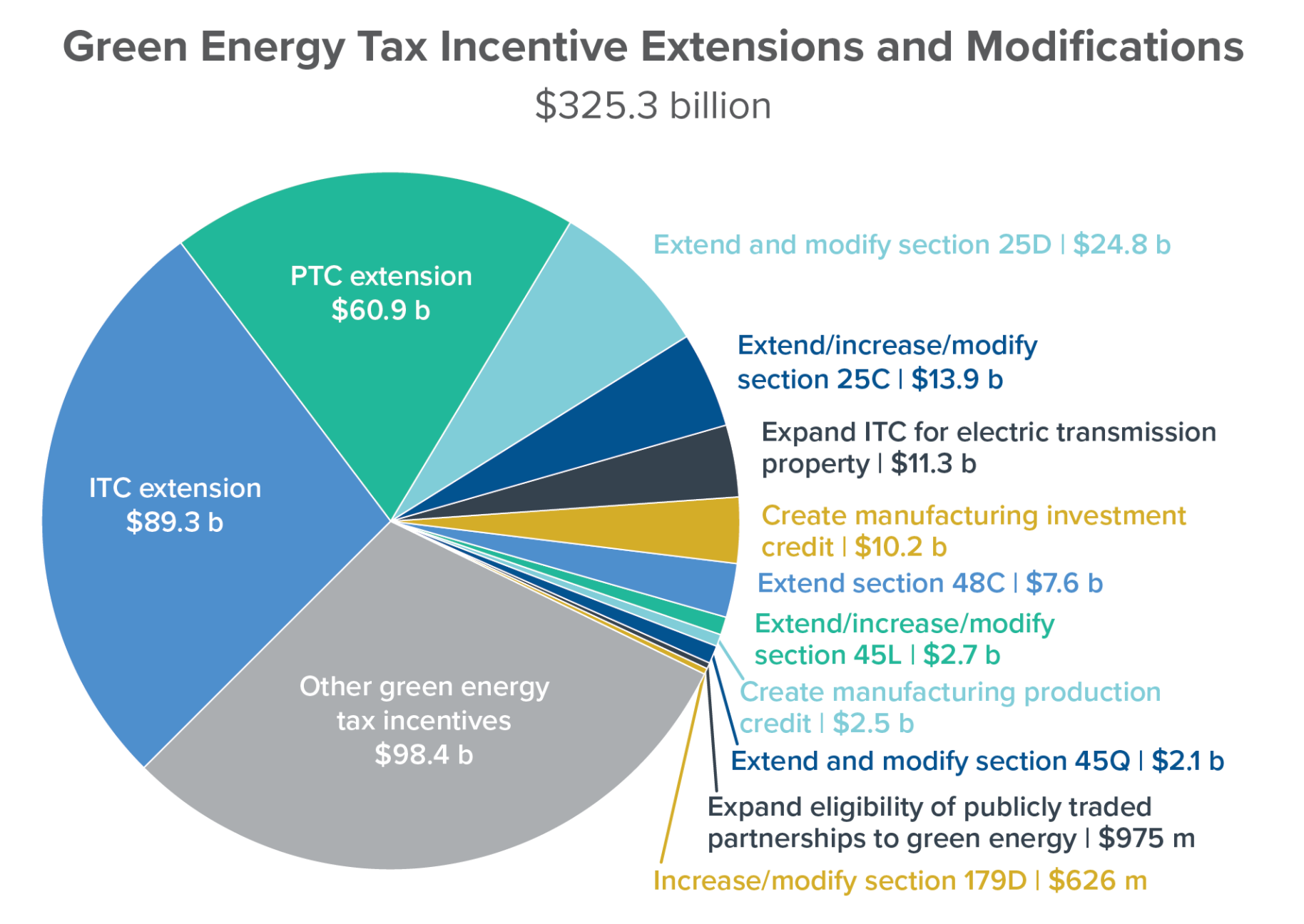

On the other hand, the bill contains some $300 billion in spending for renewable energy—by far the largest component of the climate spending in the package. It would expand tax credits for renewable power, electric vehicles, biofuels and energy efficiency. The credits could accelerate investments in both utility-scale and residential renewable energy as well as electricity transmission, power storage and “clean-energy” manufacturing. Thus, the bill uses taxpayer funds to promote “green” causes that cannot efficiently and affordably supply energy to the American public.

Build Back Better Act Attacks the Oil and Gas Industry

The bill ups the royalty rate for all new onshore oil and gas leases on federal lands to 18.75 percent, up from the 12.5 percent minimum currently. For offshore, the minimum would be 14 percent, and the policy option of royalty relief for economic reasons would be terminated.

Royalties for natural gas would cover all natural gas, including gas vented, flared, or leaked from onshore and offshore operations in the upstream, with an exception only for 48 hours of emissions during an emergency.

Onshore minimum bids and rental rates would increase, and the primary term for onshore leases in the 48 contiguous states would be limited to 5 years. An “expression of interest fee” of $15 to $50 per acre would be added to Department of Interior costs.

A new annual “conservation of resources fee” would be set at $4 per acre onshore and offshore, and a new annual “speculative leasing fee” would be set at $6 per acre for new nonproducing leases. No noncompetitive leasing would be permitted. Bonding to cover potential costs would need to be updated by Interior.

Offshore inspection fees are specified, while onshore inspection fees would be required from the Department of Interior. A severance fee would be collected by Interior at a rate of $0.50 per barrel of oil equivalent produced.

An annual fee would be levied for “idled” wells—idled for at least 2 years—and for which there is no anticipated beneficial future use.

An annual fee would be imposed on offshore pipeline owners: $1,000 per mile in waters less than 500 feet deep and $10,000 per mile in deeper waters.

The leasing program for the coastal plain of the Arctic National Wildlife Refuge would be repealed, and all payments made for leases would be returned to lessees. New exploration and production would be barred in the Pacific, Atlantic and eastern Gulf of Mexico—a codification of what has been the status quo for many years.

A new methane “waste emissions charge” would apply to all onshore and offshore oil and gas exploration and production work, as well as oil and gas gathering lines, upstream and midstream gas pipeline transmission, gas pipeline compression, onshore gas processing, underground storage, liquefied natural gas storage, and LNG import and export equipment. In other words, it will not just apply to operations on federal lands. The fee would be $900 per ton for methane emissions in 2023, $1,200 in 2024, and $1,500 thereafter. For production sites, the new fee would apply to emissions that exceed two-tenths of 1 percent of the natural gas sent to sale, though an alternative calculation also is provided. For natural gas transmission, upstream from retail utility operations, the fee would apply to emissions that exceed 0.11 percent of the gas sent to sale.

At the COP26 meeting in Scotland, the United States announced it will participate in the Global Methane Pledge to cut methane emissions 30 percent by 2030.The methane fee in the Build Back Better bill is part of Biden’s commitment to reach that goal. But, two of the world’s biggest methane emitters — China and Russia — refused to sign the Global Methane Pledge. Here again Biden wants to use Americans as examples without concern about what the financial outcome would be to American energy expenses.

Renewable Energy Benefits

The proposed bill includes a variety of renewable energy tax incentives. It would structure various credits as tiered incentives, providing either a base rate or a bonus rate of five times the base amount for projects that meet certain prevailing wage and apprenticeship requirements. An additional increased credit amount could be claimed in certain cases if projects comply with domestic content requirements, such as ensuring that any steel, iron, or manufactured product was produced in the United States.

The production tax credit (PTC) for energy facilities that produce electricity from renewable energy sources would be extended through 2026 and increased for facilities in energy communities where a coal mine or a coal-fired electric generating unit has been shut down. The PTC for solar facilities would also be reinstated through 2026. The investment tax credit would be extended through 2026 for most property and increased for projects in energy communities and for solar and wind facilities that serve low-income communities. The PTC would consist of a base credit rate of 0.5 cents per kilowatt hour and bonus credit rate of 2.5 cents per kilowatt hour through 2026.

The renewable energy investment tax credit (ITC) includes projects that begin construction before the end of 2026 and then would phase down over two years. The ITC would be expanded to include energy storage technology and linear generators. These technologies would be eligible for a 6 percent base credit rate or a 30 percent bonus credit rate. It would provide an additional 20 percent credit for the ITC if the solar facility was placed in service in connection with a qualifying low-income residential building/low-income benefit project, or an additional 10 percent credit if the facility is located in a low-income community.

The production tax credit and investment tax credit would be available after 2026 and phased out beginning in 2031 or when U.S. emissions targets are achieved.

- A new investment credit for electric transmission property that would apply to facilities placed in service through 2031.

- A new zero-emission nuclear power production credit for facilities that produce electricity, available through 2027.

- A new credit for producing clean hydrogen, based on lifecycle greenhouse gas emission rates, through 2028.

- An investment tax credit for advanced manufacturing facilities that start construction before 2026 and a production tax credit for eligible components that would begin to phase down in 2027.

- A credit for the domestic production of clean fuels that would be based on their lifecycle carbon emissions, which would also be phased out beginning in 2031 or when emissions targets are achieved.

Electric Vehicle Tax Credits

Under the Build Back Better bill a $7,500 consumer tax credit would be made refundable and expanded by $4,500 for cars assembled domestically by plants represented by unions. An additional $500 bonus would be added for vehicles that use batteries made in the United States for a total of $12,500. The legislation also would create a new $4,000 tax credit for the purchase of used electric vehicles. The new tax-credit package also eliminates the 200,000-vehicle cap, making GM and Tesla vehicles eligible again.

More expensive vehicles would not qualify for the tax credit under the current proposal. Sedans and smaller cars would only be eligible if they cost less than $55,000. For sport-utility vehicles and trucks, the sticker price would have to be under $80,000 to qualify. The proposed tax credit includes an income cap. Individuals have to make under $250,000 annually to be eligible for the credit. For households, the cap is $375,000 for a single-income family and $500,000 for a dual-income family.

The $2 trillion tax and spending bill, passed by the House, would significantly expand the nation’s demand for lithium batteries and provide opportunities for Chinese electric vehicle supply chain leaders including the Contemporary Amperex Technology Company (CATL). Based in the southeastern province of Fujian, CATL is the world’s largest manufacturer of power batteries and materials. Auto giants Daimler, BMW, and BAIC Motor Corp are customers.

Conclusion

Despite high gasoline prices stressing the U.S. consumer and home heating prices expected to soar this winter, the House Democrats are hiking fees and increasing red tape on the U.S. oil industry. The House Build Back Better bill provides oil and gas provisions that are punitive measures, including arbitrary new fees that would add millions of dollars in annual operating costs, pricing out U.S. production on federal lands and waters and taxing methane emissions from all production, even on private lands. These provisions are a gift to higher emitting producers like Russia and China that wield their energy resources as a geopolitical tool and would fundamentally weaken one of America’s most important economic, energy, emissions and national security assets. At the same time, it would give renewable technologies subsidies that they have been receiving for decades to replace efficient and affordable energy from coal, oil, natural gas and nuclear power. The result of the Build Back Better Bill is not better energy or a better life style for Americans. Rather, it is a costly measure, increasing transportation fuel, heating, and electricity bills for Americans.

*This article was adapted from content originally published by the Institute for Energy Research.

Speak Your Mind