On Tax Day, Big Wind Gets A Windfall

The wind industry often peddles the false claim that conventional energy sources like natural gas, coal, and nuclear receive more subsidies than wind power. Industry lobbyists at the American Wind Energy Association (AWEA) use this myth as a talking point to push for more subsidies, including the federal Production Tax Credit. In reality, the exact opposite is true—wind energy requires massive subsidies to compete with conventional fuels—and new data (once again) prove it.

Recently, the U.S. Energy Information Administration (EIA) released a new report on federal energy subsidies. An analysis of EIA’s data by the Institute for Energy Research found that despite the wind lobby’s claims, wind energy is by far the most heavily subsidized fuel source, receiving more subsidies to produce less energy than conventional fuels. Moreover, even the data AWEA cites to bolster its case shows that wind is a bad deal for taxpayers.

EIA Data: Wind Receives Far More Subsidies than Fossil Fuels

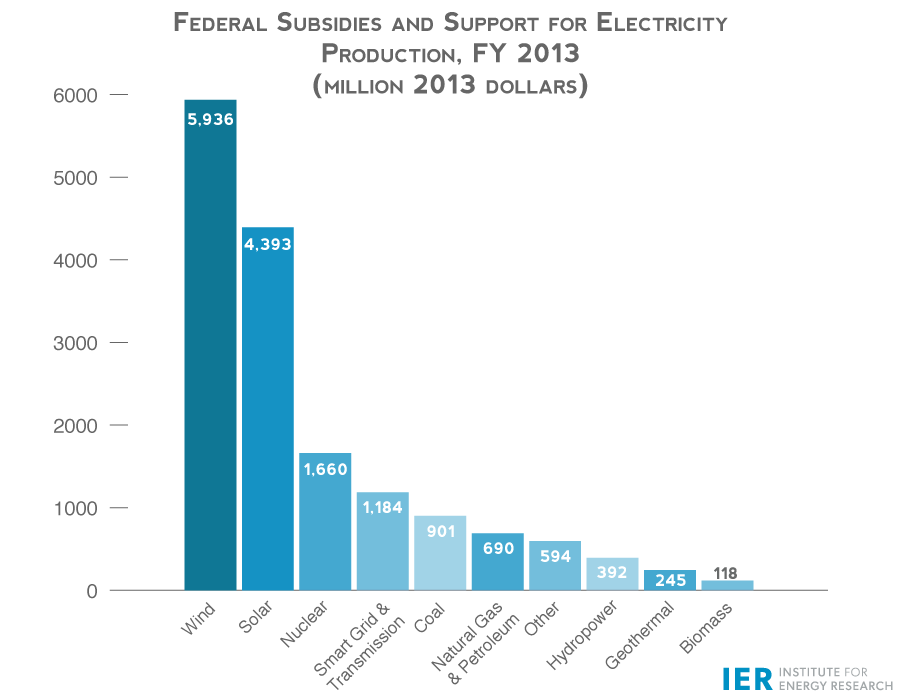

First, consider the following chart derived from EIA’s new report, Direct Federal Financial Interventions and Subsidies in Energy in Fiscal Year 2013. Wind energy received more than $5.9 billion in federal electricity-related subsidies during FY2013, which is almost twice as much as coal, natural gas, and nuclear combined. Solar received the second-most electricity-related subsidies, at nearly $4.4 billion, while all other energy sources received considerably less.

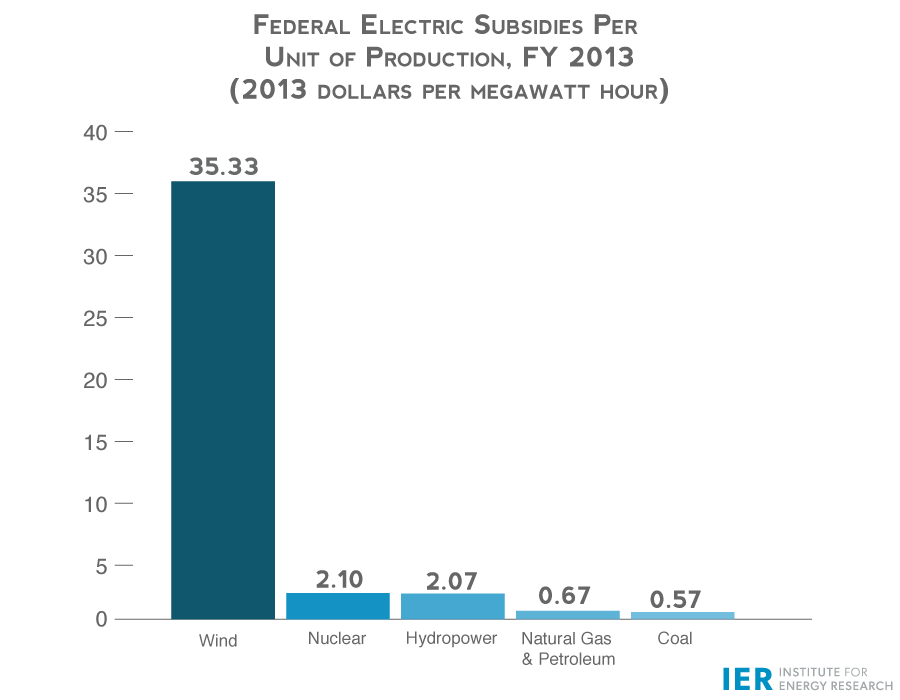

The gap widens further when we consider subsidies per unit of electrical energy produced. Once again, the data show wind receives far more subsidies than conventional energy sources. In FY2013, federal electric subsidies propped up wind to the tune of $35.33 per megawatt hour of electricity, compared to just $0.57 for coal, $0.67 for natural gas and oil, $2.07 for hydropower, and $2.10 for nuclear.

EIA’s data show that wind energy receives far more subsidies to produce far less energy than conventional fuels. Total federal electricity-related subsidies rose 38 percent between FY2010 and FY2013, while electricity-related subsidies for renewables including wind and solar climbed 54 percent. Despite generous and rising subsidies, wind energy supplies just 4.5 percent of U.S. electricity. Meanwhile, natural gas, coal, and nuclear receive far less in subsidies but generate more than 86 percent of the electricity Americans use.

Wind Lobby’s Misleading Math

After EIA released its new report, the American Wind Energy Association (AWEA) wrote a blog post that claims EIA is “missing the big picture on energy subsides” because the EIA report did not consider a longer time frame. AWEA argues that if you consider subsidies since 1950, wind’s subsidies are in line with other sources.

AWEA’s argument, however, is misleading for at least two reasons: even by AWEA’s own numbers, wind still receives more subsides per unit of total energy than conventional fuels; and AWEA uses an overly broad definition of “subsidies” that includes many tax incentives available to all domestic manufacturers, not just energy producers.

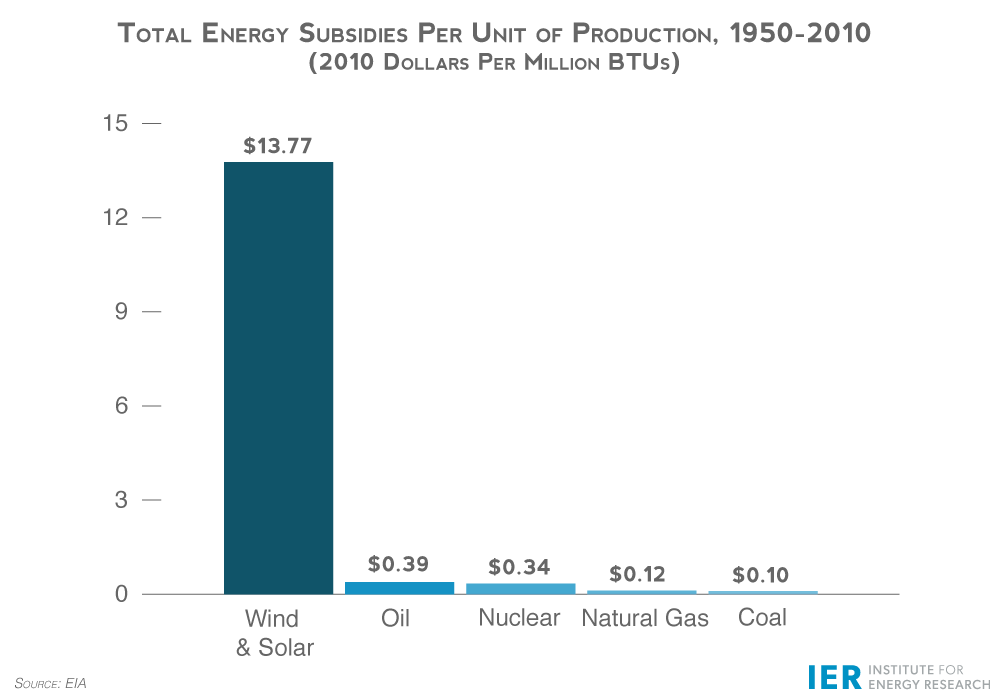

First, AWEA claims EIA misses the “big picture” by only looking at subsidies over the last three years. Instead, AWEA examines total energy subsidies between 1950 and 2010, concluding that oil received $369 billion in subsidies, natural gas received $121 billion, coal received $104 billion, nuclear received $73 billion, and wind and solar combined received $74 billion. (These figures include subsidies for all energy, not just electricity production.)

A true assessment of the “big picture,” as AWEA claims to want, requires exploring how much energy was produced for each dollar of subsidy. This could be considered the “value” to taxpayers for their “investment.” By this measure, using the numbers AWEA urges us to consider, wind still costs taxpayers considerably more than conventional fuels. As the following chart shows, wind and solar received 138 times more subsidies per million British Thermal Units (MMBTU) of energy produced than coal, 115 times more subsidies/MMBTU than natural gas, 41 times more than nuclear, and 35 times more than oil. [Note: the study AWEA cites lumps together wind and solar, so we cannot break down the data any further.]

It is misleading to compare total subsidy numbers without considering the cost per unit of energy produced. A look at the “big picture” as AWEA defines it shows that wind is still a worse deal for taxpayers. While the American Energy Alliance opposes all energy subsidies, subsidies for wind have yielded little, making them expensive for taxpayers, while subsidies for conventional fuels have come at a relative bargain.

AWEA Doesn’t Know—Or Care—What a Subsidy Is

Another issue is how AWEA defines a “subsidy.” The study AWEA cites organizes subsidies into several categories: tax policy, regulation, R&D, market activity, government services, and disbursements (grants). The largest category of total subsidies, according to this report, is tax policy, which comprises 47 percent of the total dating back to 1950.

The study defines the tax policy category as “special exemptions, allowances, deductions, credits, etc., related to the federal tax code.” Crucially, the report cites examples: “The oil and gas industries, for example, receive percentage depletion and intangible drilling provisions as an incentive for exploration and development. Federal tax credits and deductions also have been utilized to encourage the use of renewable energy.”

AWEA misses this crucial distinction between the tax incentives offered to oil and gas companies versus wind companies. The percentage depletion allowance and intangible drilling costs are not really “loopholes” but instead reflect economic reality: extracting barrels of oil really does reduce the value of an oil field, which must be taken into account when measuring an operation’s taxable net income.

Oil and gas companies cannot claim the PTC—it is exclusive to renewable energy producers. This targeted subsidy, the PTC, intentionally gives preferential treatment to wind developers at the expense of conventional producers. On the other hand, many of the incentives available to oil and gas producers are not oil and gas specific, but available to domestic manufacturers across numerous industries. That means all manufacturers generally receive similar tax treatment, while the PTC amounts to a special carve out for wind producers.

AWEA draws a false equivalence between the broad-based incentives available to manufacturers and the exclusive subsidies offered to wind developers. When the general public reads statistics about “subsidies for fossil fuels,” they naturally think these were specifically designed as arbitrary handouts for oil and gas companies; the public wouldn’t realize that much of these were features of the tax code that make accounting sense, and/or reflect broader policy goals such as “promoting domestic manufacturing.” Furthermore, since tax policy represents close to half of the subsidies in the study AWEA cites, a more realistic accounting would further increase the per-BTU subsidy cost of wind compared to conventional fuels.

Conclusion

The wind industry continues to perpetuate the myth that wind subsidies are somehow “a drop in the bucket” compared to conventional energy. A look at the “big picture,” as AWEA claims, shows exactly the opposite, with subsidies for wind dramatically outpacing those for conventional fuels. Yet wind lobbyists use this myth to argue for even more subsidies, pleading with lawmakers to level a playing field that is, in reality, already tilted in their favor. Instead of propping up certain energy technologies over others, we should end all subsidies and let energy sources compete on their own merits.

[1] Preferential tax treatment for “intangible drilling costs” is similar to accounting provisions available to other industries for qualifying business investments. Those provisions go by other names, but they have the same effect. See http://instituteforenergyresearch.org/analysis/the-obama-administrations-dishonest-claims-on-big-oil-tax-giveaways/

Speak Your Mind