Voters to Congress: Make a U-Turn on Special Vehicle Preferences

Latest AEA polling shows voters in Michigan, South Dakota, and Maine overwhelmingly distrust the federal government to make decisions about what kinds of vehicles should be subsidized or mandated.

WASHINGTON DC (October 15, 2019) – As some in Congress are attempting to extend the federal electric vehicle tax credit, the American Energy Alliance (AEA) today released the results of three more state surveys conducted by MWR Strategies that examined the sentiments of likely voters regarding tax credits for electric vehicles and their willingness to pay for them.

The surveys were administered to 800 likely voters statewide in each of three States (Michigan, South Dakota, and Maine) in September. This follows on nine essentially identical statewide surveys conducted in May (MO, PA, IA, KY, GA, SC, NC, CO, and OH). The margin of error for the surveys in each state is 3.5%.

The findings in the most recent surveys are very similar to the findings in the surveys conducted previously in other States. They include:

- There is almost no willingness to pay for others’ electric vehicles. When asked how much they would be willing to pay each year to support the purchase of electric vehicles by other consumers, the most popular answer in each State (usually more than two-thirds of respondents, 70% in Michigan, 74% in Maine, 82% in South Dakota) was “nothing”.

- As always, few voters (usually less than 1/5) trust the federal government to make decisions about what kinds of cars should be subsidized or mandated.

- Voters don’t think they should pay for other people’s car purchases. In every State, overwhelming majorities (typically three-quarters of respondents) said that while electric cars might be a good choice for some those purchases should not be paid for by other consumers.

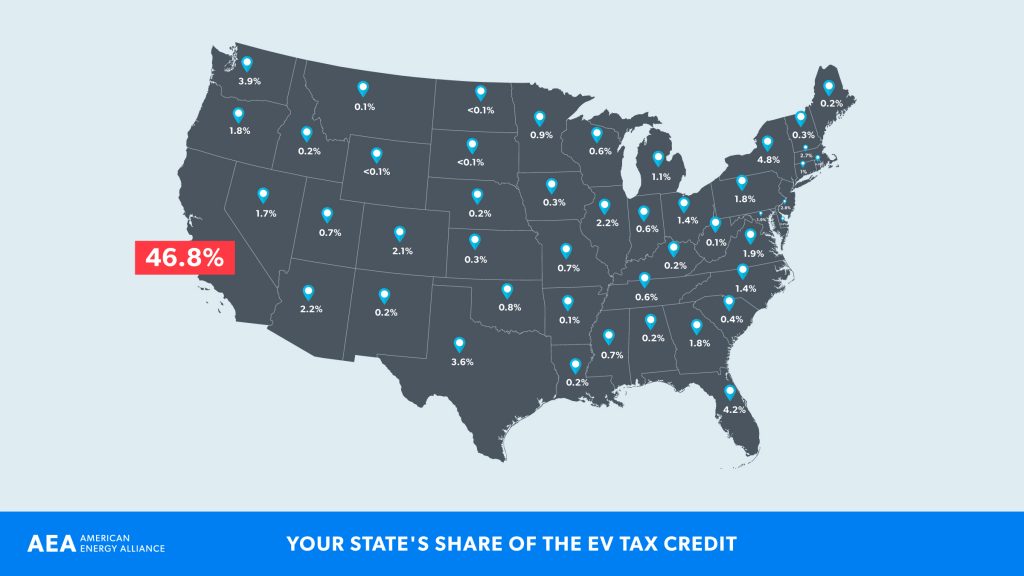

- Voters’ sentiments about paying for other’s electric vehicles are especially sharp when they learn they that those who purchase electric vehicles are, for the most, wealthy and/or from California.

Thomas Pyle, President of AEA said: “This is further evidence that efforts to compel taxpayers, ratepayers, workers, and consumers to pay for the choices of others, and the preferences of government bureaucrats, are doomed and will lead directly to voter resistance. The citizens of Maine, Michigan, and South Dakota see an expansion of the electric vehicle tax credit exactly for what it is: a giveaway to rich Californians and large, already prosperous corporations.”

Michael McKenna, President of MWR Strategies, said: “Elected officials who are concerned about voter opinion should probably think twice before expanding favorable tax treatment for electric vehicles. Voters in each of the 12 States we examined are very skeptical of them, and that skepticism extends across partisan and demographic groups.”

Additional Background:

- Federal EV tax credit: unnecessary, inefficient, unpopular, costly, and unfair

- New Survey Results Find Voters (Still) Don’t Favor EV Subsidies

- Highway Bill is Highway Robbery

For media inquiries please contact:

[email protected]

###