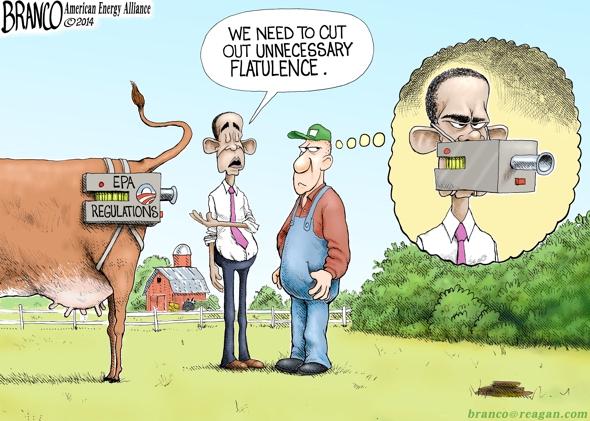

Late last year, the Obama administration exercised some common sense and issued a proposed rule to reduce the amount of renewable fuel required under the Renewable Fuel Standard (RFS) from 18.15 billion gallons to 15.21 billion gallons. EPA realized that Americans weren’t using enough fuel to blend 18.15 billion gallons of biofuel without the mandated biofuel exceeding 10 percent of the content to fuels. The 10 percent barrier matters because higher amounts of ethanol can damage engines, especially small engines. EPA’s proposed rule still has problems, but at least it was a nod toward reality.

The RFS is a biofuel mandate. It requires the use of more biofuel than the market would support. As a result, it is economically harmful and results in higher fuel prices and higher food prices (after all nearly half of the U.S. corn crop now goes to making ethanol for fuel instead of being used as food).

The biofuel industry has been built on the promise from the government that the American consumer will be forced to buy ever-increasing amounts of ethanol and biofuel. With Americans not using as much gasoline and diesel as planned, the biofuel producers are being forced to cut back:

A new study from the National Biodiesel Board, shows that the lack of certainty of federal policies is already hurting farmers and producers that help our country become more energy independent. According to the findings, nearly 80 percent of U.S. biodiesel producers have scaled back production this year and almost 6 in 10 have idled production altogether. Additionally, two-thirds of producers said they have already reduced or anticipate reducing their workforce as a result of the downturn.

The biofuel industry is reaping what they have sown. This is the foreseeable result of an industry built on forcing people to use their products. If the government policies change (of even if there is threat to change them), the industry built on the government promises will be harmed.

If the biofuel industry and their supporters were truly concerned about jobs and the economy as a whole, they would reject the RFS. The RFS artificially drives up costs in the rest of the economy, harming the economy as a whole. This comment from Tom Stacy explains why:

“Jobs within in any energy sector are “good” to the extent they support families and individuals, but the number of jobs inside any energy industry sector pale in comparison to the job creation and retention potential of least-cost plentiful, reliable energy availability to the economy at large. While the job and standard of living increases across the economy are hard to trace discretely to low energy costs, the effect is impressive and should not be ignored. May 14th, 2014 House committee testimonies supporting Amended Substitute Senate Bill 312 from Alcoa’s David Ciarlone and Timken’s Peggy Claytor are excellent examples of the leverage energy cost has on jobs across the state’s economy. Low energy costs are a competitive tool for manufacturers. The more energy intensive the manufacturing, the greater the effect. From there, warehousing, shipping and retailing all have significant energy costs borne by consumers. Keeping energy costs as low as possible fights inflation – in ways far beyond household utility bills and pain at the pump.

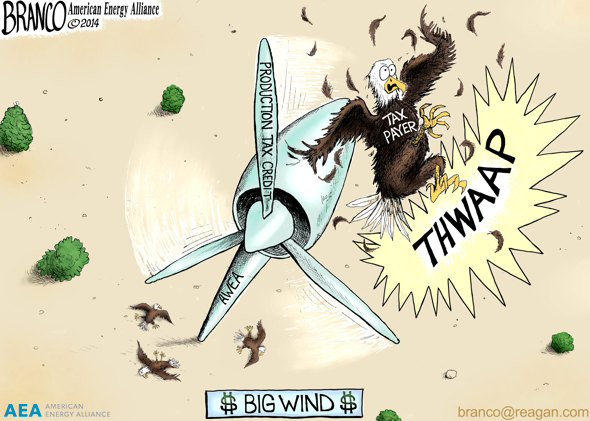

Energy technologies which are highly subsidized are almost always low value “economic losers” which end up raising the cost of energy despite the handouts they receive at taxpayer expense. When an energy technology group, such as the American Wind Energy Association, touts the jobs they create in their tiny piece of the economy, we must recognize that their industry is actually costing far more jobs across the entire economy. Yet such “trade associations” persist in their relentless public relations and lobbying efforts, largely funded by our tax dollars – and to perpetuate access to our tax dollars. Isn’t that the way a Ponzi scheme works?

Governments are coming to recognize that taxpayers are waking up, and do not wish their hard earned tax dollars to fund special interest industries when the end result is higher energy cost for everyone.”

This is exactly right. Even EPA is waking up that the RFS is unsustainable and harmful to America. Hopefully the proponents of the RFS will see that as well.

IER Director of Regulatory and State Affairs Daniel Simmons authored this post