Rep. Khanna to Propose More EV Cronyism

Congressman Ro Khanna (D. Calif.) recently announced he’s planning to introduce a bill to expand the electric vehicle (EV) tax credit in a way that promotes domestic manufacturing by linking it to carmakers producing vehicles in the U.S. Khanna touted his plan as a “concrete application of how the Green New Deal can create jobs in the United States.” I agree—his plan would be a concrete application of the Green New Deal because it would cost taxpayers a lot of money and provide benefits to the politically connected elite.

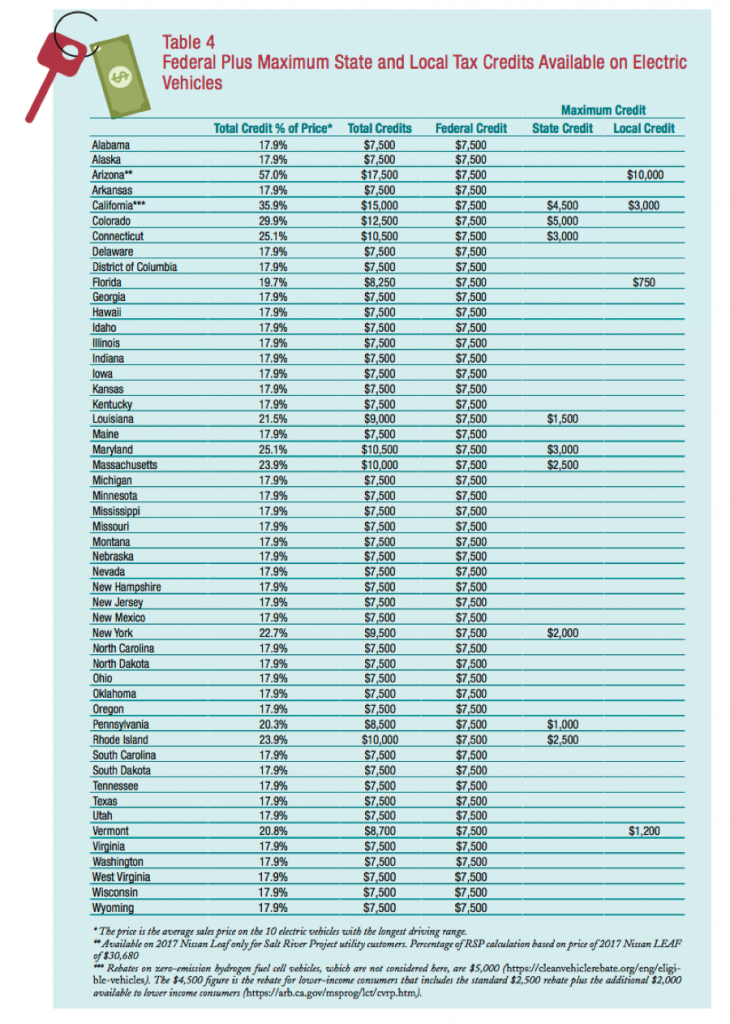

Before diving into Khanna’s proposal, it’s worth reviewing the current state of EV tax credits in the U.S. At the federal level, people who purchase new EVs currently receive a tax credit of up to $7,500; this amount is currently set to phase out once a manufacturer has sold more than 200,000 electric vehicles in the U.S. Both General Motors and Tesla breached that 200,000 vehicle mark last year.

The Pacific Research Institute provided an exhaustive list of subsidies and privileges that EV manufacturers and owners receive at the federal, state, and local level. At the federal level, EV manufacturers and consumers receive the following benefits:

- Federal manufacturing grants and loans for the purchase of EVs and the necessary infrastructure have added up to $40.7 billion; and,

- The federal government offers a $7,500 tax credit per EV consumer at a cost of $2 billion over the years.

At the state and local level:

- State and local tax credits for the purchase of electric vehicles in states like California add up to an additional $7,500 per consumer, (below, the Pacific Research Institute’s chart provides other state’s information);

- State and local advantages for EV drivers in some states include unrestricted access to high-occupancy (HOV) lanes, free parking (Hawaii), free public charging stations, and some federal employees receive free workplace charging;

- State and local tax credits are available to install EV charging stations.

On top of all of this, some states like California, have zero emission vehicle (ZEV) mandates. These mandates set an arbitrary minimum market share for ZEVs within the state and represent an indirect subsidy to companies like Tesla that specialize in ZEV sales.

As the Pacific Research Institute’s report explained, the vast majority of these benefits are going to the wealthy. In 2014, $263.3 million of EV tax credits went to consumers, 78.7 percent of which went to households with an adjusted gross income of $100,000 or higher.

But apparently there’s no limit to the economic privileges EV manufacturers and owners demand from federal, state, and local governments. Khanna’s pending proposal will reportedly seek to remove the tax credit’s 200,000-vehicle cap and link it to companies producing vehicles in the United States.

Politically speaking, this is a savvy move by Khanna, as it will probably appeal to two dangerous constituencies within the American electorate: elites who want to intervene in the American car market to favor EVs (and pass the costs along to everyone else), and people who favor government provided privileges for businesses that build things in America. However, the ability to potentially build a coalition around a proposal says nothing about whether or not it’s actually a good idea as there’s no shortage of economic illiteracy in Washington.

Khanna’s attempt to use the EV tax credit to “create manufacturing jobs” is a fundamental misunderstanding of the point of economic activity. It’s remarkable that this would be lost on someone who studied economics at the University of Chicago, but the point of an economy isn’t to create jobs; it’s to produce things that people want. In 2017, SUVs and crossovers made up more than one in three cars sold globally last year—almost tripling their share from just a decade ago. Moreover, in 2018, pickup trucks and SUVs made up 68 percent of the new auto sales in the United States. This suggests people prefer larger vehicles that offer power and performance to range-limited battery powered cars that struggle in the cold.

From a distributional perspective, the benefits of EV subsidies go almost entirely to high-income households. Some may find it remarkable that Khanna, the vice chairman of the Congressional Progressive Caucus, would support subsidies for the rich, but progressive ideology has been and always will be an ideology that favors the elite. This is because at its core, progressivism is a theory that justifies imposing costs on some in order to benefit others, but it pays little or no attention to whether or not the people imposing those costs are likely to do so in a manner that does not favor themselves. In that sense, Khanna’s plan is indeed a concrete example of the Green New Deal; it’s a handout to the wealthy and politically connected at the expense of everyone else.