The “Everybody Gets a Car!” Act

Last week, following the grand tradition of Oprah whereby guests receive free gifts just for attending, Democrats on the House Ways and Means Committee, led by Rep. Mike Thompson, announced a draft bill dubbed the Growing Renewable Energy and Efficiency Now Act (or GREEN Act). But a better name for it would be the Everybody Gets a Car Act, or perhaps the No Green Lobbyist Left Behind Act. Because just like an episode of Oprah’s favorite things, House Democrats are handing out free presents to the entire audience. And all at taxpayer expense.

Despite the billing, most of the discussion draft does not contain new ideas. Rather, it is mainly an expensive extension of a host of tax breaks for special interests that have either expired or are scheduled to phase out. The gang’s all here:

- The Production Tax Credit (PTC) for wind power,

- The Investment Tax Credit (ITC) for solar power,

- The electric vehicle (EV) tax credit,

- The biodiesel tax credit,

- Several tax breaks for for commercial and residential energy efficiency.

As for new innovations, the bill includes:

- A new tax credit for used EVs,

- New subsidies for public electric vehicles charging stations,

- Expanding ITC eligibility to cover batteries, and

- A billion dollars (that’s billion with a B) per year for environmental justice programs at universities. (Note: It is not clear how exactly an endowed professorship in environmental justice combats climate change, but hey since we are spending money why not give everyone some?)

Big subsidies, little power

The inclusion of the PTC and ITC in this bill is a particularly egregious example of Washington doublespeak. In 2015, a grand bargain was reached on a multi-year extension of the PTC and ITC in exchange for a phase down of the value of those two tax subsidies. At the time, and for many years since, we were assured by the wind and solar industries that their technology was mature and ready to compete on a level playing field. For years now the media has been filled with assertions that wind and solar power generation are so competitive they are actually cheaper than their conventional competitors!

But as the phase down deadlines have drawn closer, the tune has predictably changed. Suddenly these supposedly super-competitive generation sources cannot survive without continued subsidies. Under the current phase down plan, the PTC alone is already expected to cost almost $33 billion over the 10 years to 2028. But they need more? Keep in mind that these billions are being spent to subsidize an industry that provided only 6.5% of electricity generation in 2018. The ITC, projected to cost over $30 billion, subsidizes a solar industry that provides a mere 1.5% of generation.

The inclusion of new subsidy eligibility for battery storage really exposes the underlying folly of relying on wind and solar electricity generation. At small percentages, wind and solar can slot into the existing electricity grid fairly easily because reliable power sources can be forced to (expensively) adjust to the only sometimes on wind and solar generation. But at greater penetrations, even those a long way short of the 100% renewables fantasy being pushed in some quarters, wind and solar are too unreliable to power a modern economy. They require backups for when the sun is not shining and the wind is not blowing. Right now, that backup is mostly provided by natural gas, but in the 100% renewables fantasy, backup is supposed to come from vast fields of batteries. Very expensive batteries. That also must be subsidized.

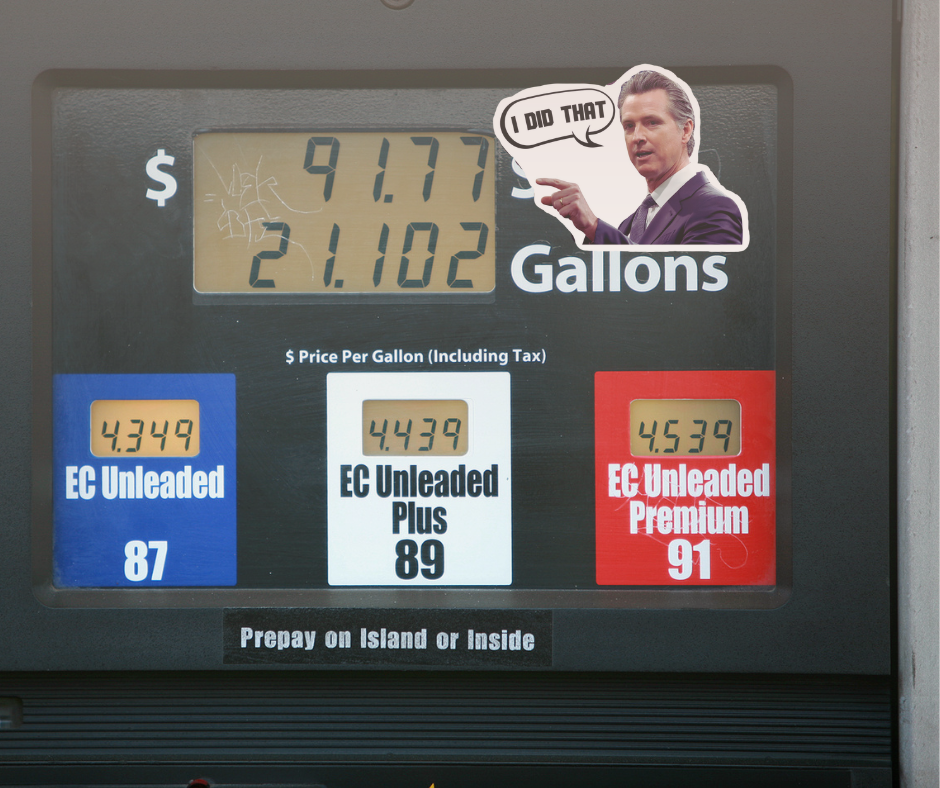

The PTC and ITC provisions of this bill expose a stark truth: the authors know that renewable generation is a creature of government. Wind and solar must be subsidized to be built and then batteries must be subsidized to provide backup. And if spending their tax dollars on subsidies on the front end isn’t enough, taxpayers end up paying again for the higher electricity rates that come with a more renewable electricity grid and end up with less reliable power (see California, the UK, and Australia for examples).

Subsidizing toys for coastal elites

The route that the draft bill takes for expanding electric vehicle subsidies is drawn from the Drive America Forward Act, introduced earlier this year. As AEA has previously described, the EV tax credit is unnecessary, inefficient, unpopular, costly and unfair.

- 70 percent of EV owners would have purchased their vehicle without receiving a subsidy, which is not surprising given that 78 percent of credits go to households making more than $100,000 a year.

- As AEA has extensively documented over many years, voters don’t like being forced to subsidize electric vehicle purchases.

- The existing EV tax credit already stands to cost taxpayers $9.7 billion.

- In 2018, over 46 percent of new electric vehicle sales were made in California alone, though California represents only about 12 percent of the U.S. car market.

Add these factors up and you have a program that subsidizes wealthy people, mostly living on the coasts, to buy an expensive vanity car, all at the expense of taxpayers and consumers in the rest of the country.

The one virtue in the design of the EV tax credit, though, is that it at least terminates after a given car manufacturer has sold 200,000 vehicles—giving it an end date. This draft bill, however, would expand that cap to 600,000 vehicles. One estimate puts the cost of this expansion at $15.7 billion. Add that to the nearly $10 billion in taxpayer money already committed to EV subsidies, and we are looking at spending $25 billion to subsidize fancy toys for coastal elites.

No special interest left behind

The draft bill includes an extension of the biodiesel tax credit, which since 2005 has provided a $1 per gallon subsidy for this niche product. This credit was originally created to reduce US oil imports in favor of domestic biodiesel production. But in the interim, the shale oil boom means that the US is now the world’s largest oil producer and is projected to be a net oil exporter as soon as next year. In the midst of this abundance, one might question why the federal government should continue to subsidize biodiesel. But for a special interest lobbyist there is no such thing as a temporary program.

Also included is a new subsidy for public electric vehicle charging stations. If the subsidies for the purchase of the EVs in the first place weren’t enough, now the federal government is being asked to subsidize their fueling too. An EV’s range is only as great as it’s battery capacity, and unlike a gas-powered vehicle, it cannot be fueled up in five minutes and driven away. The “solution” offered is providing charging stations in as many places as possible: grocery stores, apartment buildings, government offices, malls, you name it. But all this infrastructure is expensive. New power connections, especially for chargers that don’t take hours to charge, do not come cheap. And who better to subsidize this expensive overbuilding of infrastructure than the hundreds of millions of taxpayers who don’t own electric vehicles, right?

The rest of the draft is a grab bag of handouts to seemingly everyone who has taken a meeting with the Ways and Means Democrats, but one final provision stands out as a bizarre non sequitur. Despite the asserted goal of “addressing the threat of climate change through the tax code,” the draft bill includes $5 billion in subsidies for so-called environmental justice programs at universities. The bill is silent on how subsidizing fringe university social science departments fights climate change, but clearly those activists had a great lobbyist.

Let’s make a deal: everyone gets a pony

Even if this bill as written is not going to pass into law, it should not be taken lightly. This is the first step in the venerable Washington tradition of logrolling: hand out enough goodies to enough special interests to roll up sufficient votes and then insert the whole collection of giveaways into a larger bill. The proponents of this bill want to jam as many of these handouts into a tax extenders grand bargain. This bloated, reanimated corpse of currently dead (and dying) tax provisions can then be tacked onto must past legislation at the end of the year, such as a spending bill that forces the acceptance of this special interest pork fest as a requirement to fund the government. However draped in green clothing, it’s an old game. The only question is whether more sober members of Congress will give this bill the dismissal it so richly deserves.