It’s time for the EV tax credit to be ended, not extended.

The federal electric vehicle tax credit is a misguided and outdated policy that sends a clear and unavoidable message that we trust government, rather than consumers, to decide what kinds of cars Americans should buy.

It’s time for the tax credit, which offers $7,500 to purchasers of the first 200,000 EVs sold per manufacturer, to come to an end.

The justification for this tax credit was to reduce our dependence on foreign oil. Today, America leads the world in energy production. Though the tax credit is no longer needed, lobbyists in Washington are asking for lawmakers to extend the manufacturers’ cap.

Why should taxpayers be subsidizing wealthy people purchasing luxury goods? The Pacific Research Institute published a study earlier this year showing that 78.7 percent of the EV tax credits went to households with an adjusted gross income of $100,000 or higher, and more than half went to households with an adjusted gross income of more than $200,000.

As IER has documented in the past, lawmakers should not extend the EV tax credit as the policy is unnecessary, inefficient, unpopular, costly, and unfair.

Unnecessary and inefficient

The EV tax credit is not necessary to support an electric vehicle market in the U.S. as one group estimates that 70 percent of EV owners would have purchased their vehicle without receiving a subsidy, which is reasonable seeing as 78 percent of credits go to households making more than $100,000 a year. Furthermore, the federal tax credit overlaps with a number of other government privileges.

Unpopular

Lawmakers should be aware that the vast majority of people do not support subsidizing electric vehicle purchases. The American Energy Alliance recently released the results of surveys that examine the sentiments of likely voters about tax credits for electric vehicles. The findings include:

- Voters don’t think they should pay for other people’s car purchases. In every state, overwhelming majorities (70 percent or more) said that while electric cars might be a good choice for some, those purchases should not be paid for by other consumers.

- As always, few voters (less than 1/5 in all three states) trust the federal government to make decisions about what kinds of cars should be subsidized or mandated.

- Voters’ sentiments about paying for others’ electric vehicles are especially sharp when they learn that those who purchase electric vehicles are, for the most part, wealthy and/or from California.

- There is almost no willingness to pay for electric vehicle car purchases. When asked how much they would be willing to pay each year to support the purchase of electric vehicles by other consumers, the most popular answer in each state (by 70 percent or more) was “nothing.”

Costly and unfair

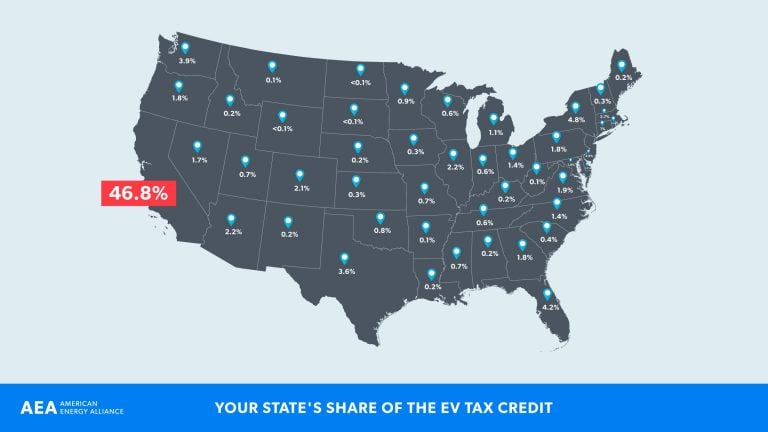

Most importantly, an extension of the federal EV tax credit is unfair as the policy concentrates and directs benefits to wealthy individuals that are predominantly located in one geographic area, namely California. A breakdown of each state’s share of the EV tax credit is displayed in the map below:

While the tax credit is misguided as a whole, at least its drafters had the foresight to limit the harm that it could do by ensuring that it only applied to the first 200,000 electric cars from a given manufacturer. That admirable restraint should not be jettisoned now.

If policymakers in Washington were to lift the manufacturers’ cap provision of the tax credit, they would inflict further economic harm on American households to the tune of a $95 billion value reduction between 2020 and 2035.