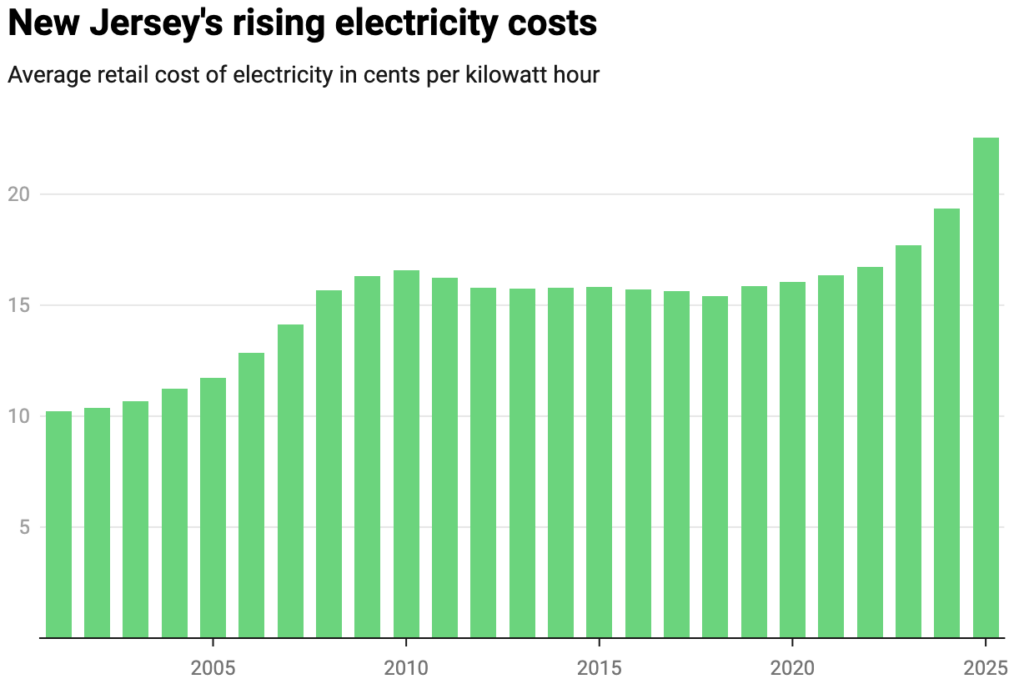

New Jersey’s governor, Mikie Sherrill, declared a formal emergency over rising electric bills and ordered regulators to intervene in rate hikes, using the Disaster Control Act. Sherrill directed regulators to stop electric rate increases, effectively freezing rate hikes that were to go into effect in the coming months. She also warned that, without structural changes, nuclear power and other long‑term investments into renewable energy and battery storage will be needed to stabilize prices. As reported by Morning Overview, her directive orders the state Board of Public Utilities to create “Residential Universal Bill Credits” that would appear directly on household statements to offset rising charges. Her Executive Order No. 1 program is tasked with subsidizing residential customers while her administration works on deeper reforms, meaning the bill credits are intended to be a bridge to a longer-term policy. Former New Jersey Governor Phil Murphy took similar action last year, but that did not fix the rising electricity price problem.

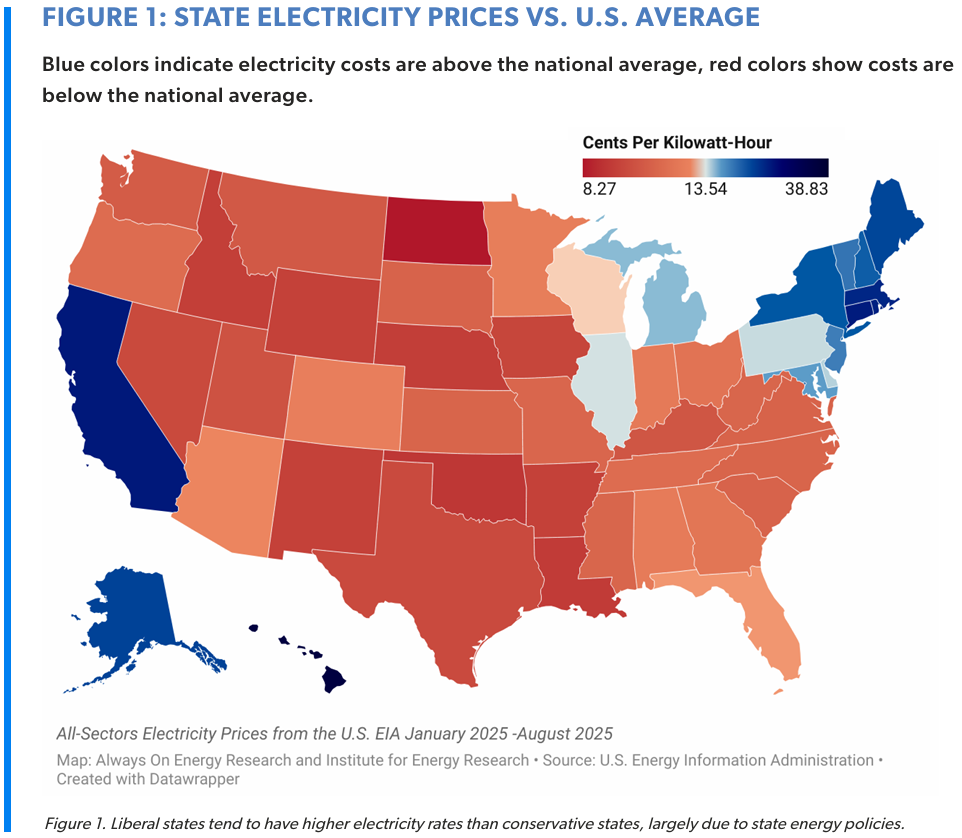

New Jersey has the 12th-highest residential electricity prices in the country at 22.55 cents per kilowatt hour as of October 2025, 25% higher than the national average at 17.98 cents per kilowatt hour. Currently, natural gas and nuclear generate the bulk of the state’s electricity, with nuclear producing 45% and natural gas 49%; renewables are at 4%. While traditional baseload technologies are providing 94% of the state’s electricity, the policies of New Jersey Governor Murphy over the past eight years and now Governor Sherrill are making electricity prices rise.

New Jersey is a founding member of the Regional Greenhouse Gas Initiative (RGGI), a cap and tax program designed to reduce greenhouse gas emissions in electricity generation by forcing utility generators to buy allowances for the carbon dioxide emissions they release over a predetermined amount set by its ten regional members. The cost of the allowances is added to the electricity bills that consumers pay. Pennsylvania recently withdrew from the pact while Virginia rejoined under new Governor Spanberger.

New Jersey also has a renewable portfolio standard that requires it to generate 50% of its electricity from renewable sources by 2030 — a bill signed by Governor Phil Murphy in 2018. In promoting renewable energy, he advocated for offshore wind facilities — a very expensive generating technology since it requires developers to mount the wind turbines in rough ocean waters, run extensive cables underground to bring the power to the coast, and maintain the turbines in turbulent ocean waters, which makes their operating and maintenance costs almost five times that of onshore wind. Besides its direct costs, it requires back-up power via a dispatchable technology such as natural gas, nuclear, or coal,when the wind is not blowing, which adds to the cost consumers pay. On top of that, New Jersey has less spare dispatchable capacity as it shut down its last coal plant in 2022, under the policies of Governor Murphy. It is unfortunate that Governor Sherrill is planning on using those same policies.

During Winter Storm Fern, coal was used by many states to keep the lights on and residents warm. In the week ending January 25, 2026, coal-fired electricity generation in the Lower 48 states increased 31% from the previous week, according to the U.S. Energy Information Administration. Coal accounted for 21% of all electricity generation in the Lower 48 states over that period, up from 17% the previous week. It was the second-largest source of energy used for electricity, following natural gas, which contributed 38%, and nuclear, which was third at 18%.

However, New Jersey no longer has that option after it shuttered five coal-fired power plants and one nuclear plant since 2017 under Governor Murphy’s term in office — a combined loss of more than 2,500 megawatts of firm generating capacity. That left the state grappling with dwindling in-state generation capacity and increasing reliance on imported electricity. Governor Phil Murphy thought he could deliver “reliable and affordable green energy alternatives,” which, frankly, do not exist. New Jersey’s hopes for a transition to “green” energy outpaced its replacement infrastructure, raising concerns about grid stability, cost volatility, and energy independence.

As the Shore News Network explains, with no new large-scale generating stations coming online to replace the decommissioned plants, New Jersey turned increasingly to electricity imports from neighboring states, such as Pennsylvania, which resulted in a strain on regional transmission systems and greater exposure to external market forces. The state was warned that the result could be higher utility bills, grid reliability concerns, and a lag in meeting renewable energy targets — all of which have occurred.

NJ.com reports that officials from the PJM interconnection indicated that, while demand has been increasing, New Jersey’s existing supply has left the system due primarily to state policy and federal rules from previous administrations. According to PJM, “The bottom line…is that these affordability concerns are being driven by an imbalance in electricity supply and demand. PJM wholesale power markets are sending a price signal that reflects this imbalance, which is caused by electricity supply not being constructed at a pace to keep up with increases in electricity demand, mainly driven by data center buildout. This issue is acutely problematic in New Jersey because it imports about 40% of its power from out of state.”

Governor Sherrill blames PJM’s capacity market on rising prices because capacity prices in auction markets run by PJM soared over 800% in 2024, according to her executive order. She ignores that the policies of the state to remove firm capacity are causing the problem of rising electricity prices for her state and higher prices for PJM’s capacity auction as well. And while neighboring Pennsylvania withdrew from RGGI, New Jersey remained, adding costs to electricity bills.

Analysis

Under Governor Sherrill’s policies, people and businesses in New Jersey should expect higher prices. Taxing carbon dioxide emissions through RGGI and forcing “green” energy sources onto the grid through a Renewable Portfolio Standard and subsidized offshore wind lead to higher energy prices by directing investment away from energy sources that are cheap and reliable. As IER’s Alex Stevens explains for the New York Post, “Prices are the sharpest signal that markets send, and it’s really the only way that so many people engaging in an economy can coordinate supply and demand. If you impose price controls or ceilings, you basically blind everybody from the information about where supply needs to increase.”

*This article was adapted from content originally published by the Institute for Energy Research.