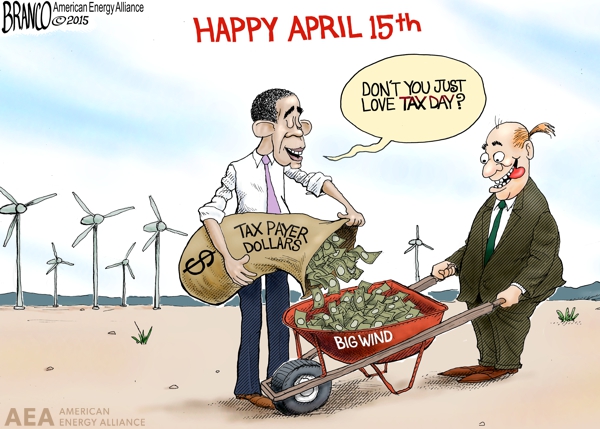

Taxes In The Wind

The federal wind Production Tax Credit (PTC) is an incredibly wasteful subsidy that doles out billions of taxpayer dollars to the wind industry and threatens the affordability and reliability of electricity generation from natural gas, coal, and nuclear power. A report by the Institute for Energy Research makes the case for ending Big Wind’s favorite handout. Highlights from the report include:

- The PTC is costly. A two-year extension will cost $13.35 billion, which is enough to pay 124 million Americans’ monthly electricity bills.

- Americans oppose the PTC. A survey by the American Energy Alliance finds that 65 percent of voters believe two decades worth of tax credits for the wind industry is long enough.

- The PTC threatens grid reliability. Wind typically produces the most power when it is needed least: one study finds that “over 84 percent of the installed wind generation infrastructure fails to produce electricity when electric demand is greatest.

- Wind energy is expensive. When all factors are considered, wind energy costs $109 per megawatt hour, which is twice as much as this year’s average wholesale electricity price of $54 per MWh.

- A vote for the PTC is a vote for Obama’s climate agenda. A key “building block” of EPA’s CO2 rule for existing power plants is increased wind generation. But wind energy depends on the PTC: wind installations dropped 92 percent after the PTC expired at the end of 2012.

So when you’re thinking about what your tax dollars are going towards on April 15th, remember that Big Wind is living large on your dime.

Click here to read IER’s full report.

Speak Your Mind