When you’re an environmentalist and you’ve lost The Washington Post editorial board, it might be time for soul searching. Last week, the same editors who support EPA’s carbon dioxide rules and routinely call for a carbon tax came out against New York Governor Andrew Cuomo’s decision to ban hydraulic fracturing in the Empire State, dubbing it “ignoble” and “the wrong approach.”

As the editors explain:

State regulators admit they have no proof that fracking has been responsible for many of the harms that motivated them to ban the practice. Fracking done badly is the real concern. Strong rules can and should limit the risks. New York’s outright ban is justified only by extreme caution.

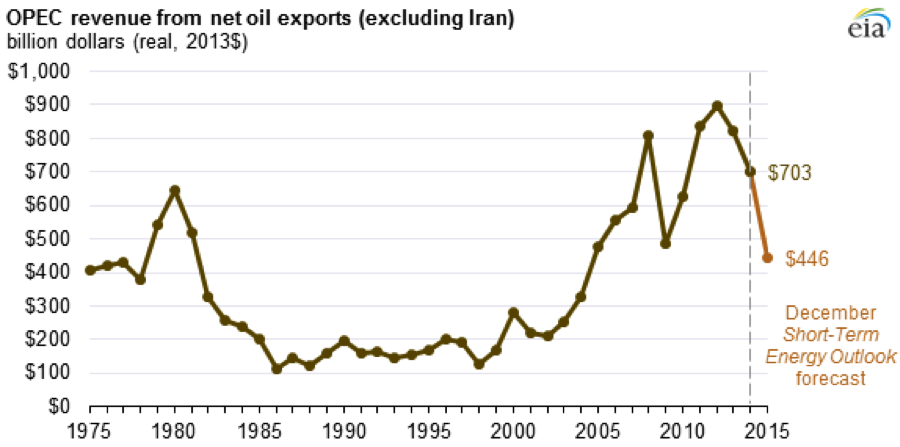

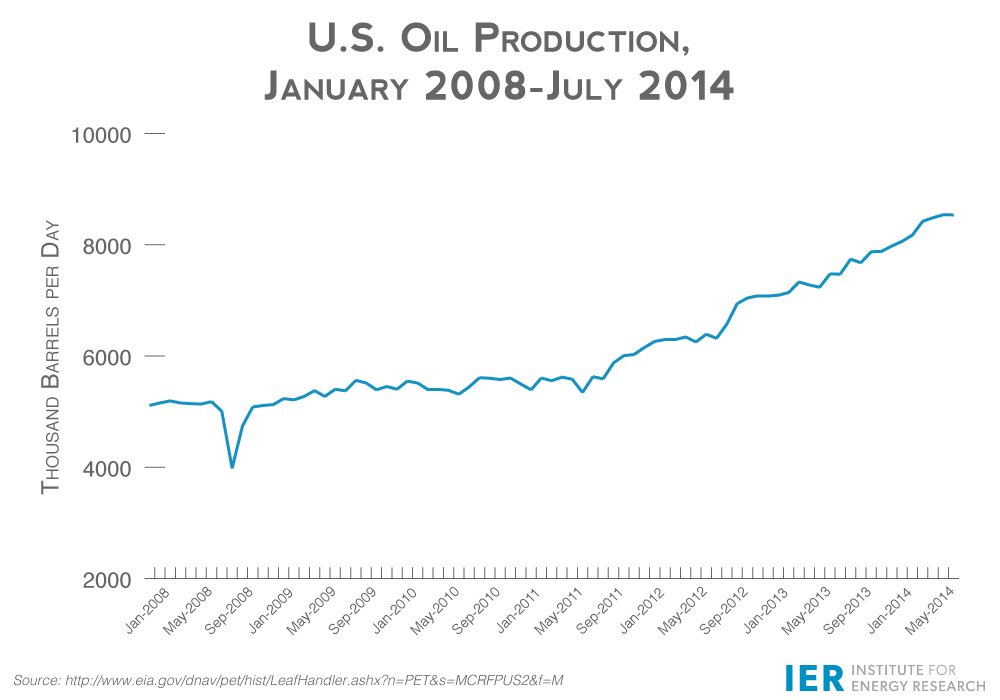

Meanwhile, natural gas produces far more of New York’s electricity than any other source. The gas that runs the state comes from domestic drilling sites, including from fracked wells in next-door Pennsylvania. In other words, whether New Yorkers want it to be so or not, the state is implicated in the fracking business. The benefits of burning the fuel are just too attractive. Tapping massive U.S. natural gas supplies has pushed down prices. Cheap natural gas lowers energy bills. And, compared with the range of serious health and environmental harms that come from burning coal, natural gas’s most immediate substitute, a sensible environmentalist would choose fracked gas any day.

Natural gas isn’t just New York’s largest source of electricity—it represents the state’s largest source of total energy consumption (including gasoline). New Yorkers could meet more of their energy needs through domestic natural gas production, but that requires hydraulic fracturing. Instead, they import most of their natural gas from states like Pennsylvania, where hydraulic fracturing in the Marcellus shale has brought jobs, prosperity, and lower energy bills—New York’s electric bills are 36 percent higher than neighboring Pennsylvania’s.

The defeatist attitude of environmentalists who oppose all hydraulic fracturing belies the ingenuity of the American people. No energy source is without risk. But risks can be managed and technical challenges can be overcome. Hyping potential risks—in the absence of actual harm—may help activists make noise and raise money, but it is no excuse to ban responsible energy development.

AEA energy analyst Alex Fitzsimmons authored this post.