Will EPA’s regulations on carbon dioxide emissions from power plants result in reduced reliability of the electricity grid? Yes, according to the national electricity grid overseer—the North American Electric Reliability Corporation (NERC).

NERC recently released an initial reliability review of the potential risks to reliability. Using the assumptions in EPA’s report, NERC found that “Essential Reliability Services may be strained” and that “more time for CPP [EPA’s regulation] may be needed to accommodate reliability enhancements.”

In terms of Essential Reliability Services (ERS), NERC explains:

“ERSs are the key services and characteristics that comprise the following basic reliability services needed to maintain BPS reliability: (1) load and resource balance; (2) voltage support; and (3) frequency support. New reliability challenges may arise with the integration of generation resources that have different ERS characteristics than the units that are projected to retire. The changing resource mix introduces changes to operations and expected behaviors of the system; therefore, more transmission and new operating procedures may be needed to maintain reliability.”

Regarding accommodating reliability enhancements, NERC points out:

“State and regional plans must be approved by the EPA, which is anticipated to require up to one year, leaving as little as six months to two years to implement the approved plan. Areas that experience a large shift in their resource mix are expected to require transmission enhancements to maintain reliability. Constructing the resource additions, as well as the expected transmission enhancements, may represent a significant reliability challenge given the constrained time period for implementation. While the EPA provides flexibility for meeting compliance requirements within the proposed time frame, there appears to be less flexibility in providing reliability assurance beyond the compliance period.”

NERC did not examine the costs of all of these additional features required to maintain reliability after EPA regulations come into effect. The costs will be substantial. EPA regulations cause reliable and affordable power plants to close, and they will require the building of newer and more expensive plants. Since EPA is providing incentives to build non-reliable sources of generation, such as wind and solar, the electric grid will require, as NERC points out, more transmissions, more resources for voltage support, and more resources for load and resource balancing. Cumulatively, implementing these necessary features will lead to higher costs than EPA originally suggested.

What does EPA have to say about this report? It implied that it knows more about grid reliability than NERC does, even though NERC is the recognized expert in grid reliability. EPA’s spokeswoman Liz Purchia said, “Our analysis finds that the proposal would not raise significant concerns over regional resource adequacy or raise the potential for interregional grid problems…Any remaining local issues would be managed, as they are today, through standard reliability planning processes.”

Who are you going to trust when it comes to grid reliability: NERC—an organization devoted to grid reliability—or EPA—an organization that (when viewed in the most favorable light) is supposed to protect the environment? EPA should take heed of NERC’s evaluation and seriously consider the negative impacts of its environmental regulations on grid reliability.

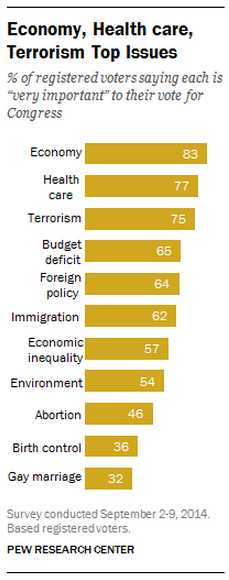

These results square with a poll AEA conducted, which revealed that economic and fiscal issues still reign supreme over environmental and climate issues. AEA found:

These results square with a poll AEA conducted, which revealed that economic and fiscal issues still reign supreme over environmental and climate issues. AEA found: