The Wind PTC: What It Is And Why Congress Should Reject It

When Congress returns for the start of the lame duck session this week, they will discuss whether to approve a retroactive extension of the expired Production Tax Credit (PTC), which primarily benefits foreign and domestic wind companies. For a host of reasons, they shouldn’t. Most importantly, they shouldn’t because the PTC is inextricably linked to the proposed EPA regulation of carbon dioxide on existing power providers, and therefore a vote in favor of reinstating the PTC is a vote in favor of President Obama’s climate agenda. I will explain why this is the case in subsequent blog posts, but first a brief review of the history and function of the PTC is in order.

In April, the Senate Finance Committee approved an $84 billion extension of roughly 60 expired tax provisions. The measure contains no offsets and includes a retroactive extension of the wind PTC, which expired at the end of 2013. The House has taken a piecemeal approach to the expired tax provisions, and it has not put forward an extension of the PTC.

The most vocal and active proponents of an extension of the wind PTC include wind industry lobbyists at the American Wind Energy Association (AWEA) and national environmental organizations like the Sierra Club and the League of Conservation Voters. The PTC’s opponents include the American Energy Alliance (my organization and the publisher of this blog), a growing group of think tanks, and many power grid experts and utility CEOs.

Background and History of the PTC

The PTC was initially enacted through the Energy Policy Act of 1992 as a temporary measure that expired in July 1999. Since the credit’s establishment, the measure has been temporarily extended seven times by subsequent pieces of legislation: the Ticket to Work and Work Incentives Improvement Act of 1999; the Job Creation and Worker Assistance Act of 2002; the Working Families Tax Relief Act of 2004; the Energy Policy Act of 2005; the Tax Relief and Health Care Act of 2006; the American Recovery and Reinvestment Act of 2009; and the American Taxpayer Relief Act of 2012.[1]

Senator Chuck Grassley, the original author of the PTC language, has repeatedly said the PTC is a temporary subsidy to get the wind industry on its own two feet. In 2003, when the subsidy was already 11 years old, he predicted, “we’re going to have to [subsidize wind] for at least another five years, maybe for 10 years. Sometime we’re going to reach that point where it’s competitive.” Now, another 11 years later, he’s asking for more subsidies because wind still can’t compete.

Who receives the PTC? The credit goes to owners of wind turbines for the first ten years of operation of any qualifying wind facility. For the first twenty years of the PTC’s existence, facility had to be operating before the PTC expired in order to qualify to receive the credit. However, in the most recent extension (through the 2013 calendar year), Senator Grassley expanded the qualification language to include facilities that had started “construction” before the PTC’s expiration.

In response to the language change, the Internal Revenue Service (IRS) released guidelines that defined “construction” in terms of financing as well as physical work. As a result, a developer can circumvent the need to physically start construction of a project and instead rely on mere financing in order to qualify for the PTC. Going one step further, the IRS also said a wind facility would qualify if it is placed in service before January 1, 2016, which amounts to a two-year extension of the PTC (through calendar years 2014 and 2015) under the original terms of the legislation.

Basic Function and Purpose of the PTC

Wind is an expensive way to generate electricity. Without the support of the PTC and other subsidies, wind turbines cannot compete with conventional sources. Some wind facilities would have been built without these subsidies, but nowhere near as many facilities as have actually been constructed.

The PTC is not a subsidy to consumers. Rather, it is a business subsidy that goes to developers of industrial wind turbine facilities and works through the mechanism of project finance. It lowers the cost of industrial financing and offers big investors like Warren Buffett a convenient way to lower their tax rate. As Buffett recently commented, wind turbines “don’t make sense without the tax credit.”

The PTC functions by providing a tax credit on a per-kilowatt-hour basis to businesses that operate qualified wind facilities. Originally, the credit was disbursed at a rate of 1.5 cents per kWh (in 1993 dollars), but it has been increased in order to keep up with inflation. When it expired in 2013, the PTC had been raised to 2.3 cents per kWh for wind technologies.

To put the size of the subsidy in context, the PTC offers the equivalent of 30% to 50% of the average wholesale price of power, depending on the region, for the entirety of a ten-year period. This subsidy is so substantial that wind producers can afford to pay the grid to take their unwanted power and still make money. This phenomenon is known as negative pricing, and it threatens the long-term reliability of the power grid.

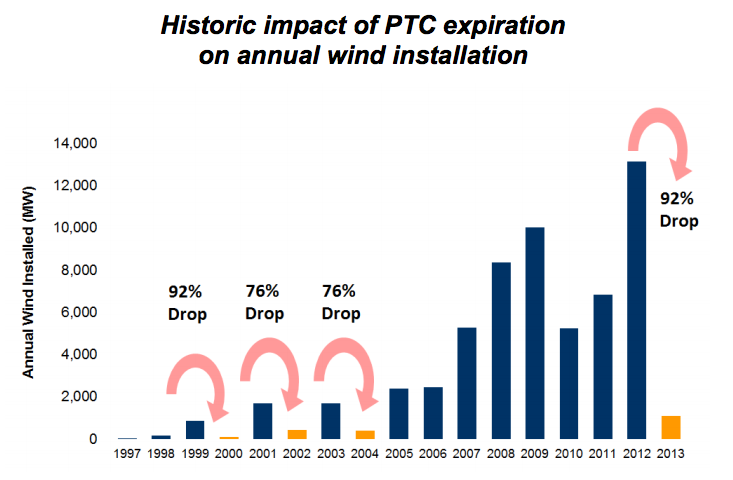

It is no surprise that a subsidy so large would drive businesses to build wind turbines, and the data reflects the wind industry’s reliance on the PTC. When the PTC has been available, installations have jumped. When it has expired, as it did in 2000, 2002, 2004, and 2013, installations fell off sharply. For instance, between 2012 and 2013, installations of new wind capacity fell from 13,000 MW (2012) to only 1,100 MW (2013).

Source: American Wind Energy Association

In essence, the PTC is a catalyst that gets uneconomic wind power projects built. It is particularly effective at financing projects that would not otherwise be built.

Conclusion

Congress should reject any attempt to revive the wind PTC. Since 1992, this taxpayer-funded subsidy has been extended seven times, yet wind energy remains scarce and expensive. While it lines the pockets of wealthy investors, the wind PTC raises energy prices on American families and threatens grid reliability. Much worse, the PTC is integral to the success or failure of even worse public policy, namely the EPA’s power plant rule. Stay tuned to Energy TownHall to learn how.

Speak Your Mind