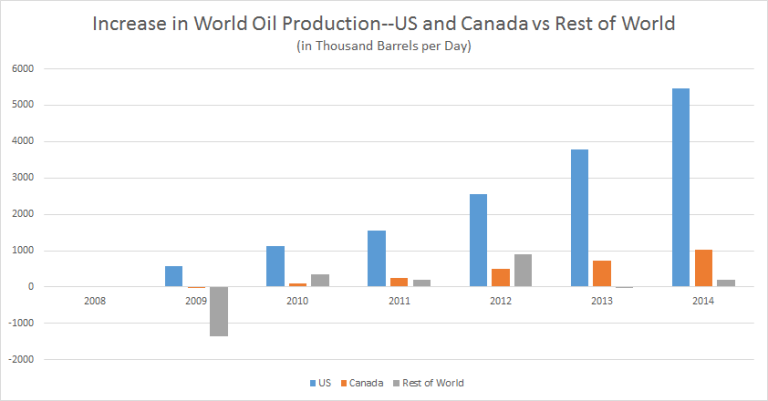

With all the discussion in the media about OPEC, about the Saudis and the Russians, and about the relationship between oil prices and the stock market, there seems to be no discussion about the elephant in the room. The real reason we have low oil prices today is because since 2008, U.S. oil producers – along with some help from Canada – dramatically increased oil production. The U.S. government did nothing to help; in fact, oil production from U.S. federal lands and waters actually decreased since 2010. Private enterprise and free markets, here and in Canada, drove oil production up and oil and gas prices down.

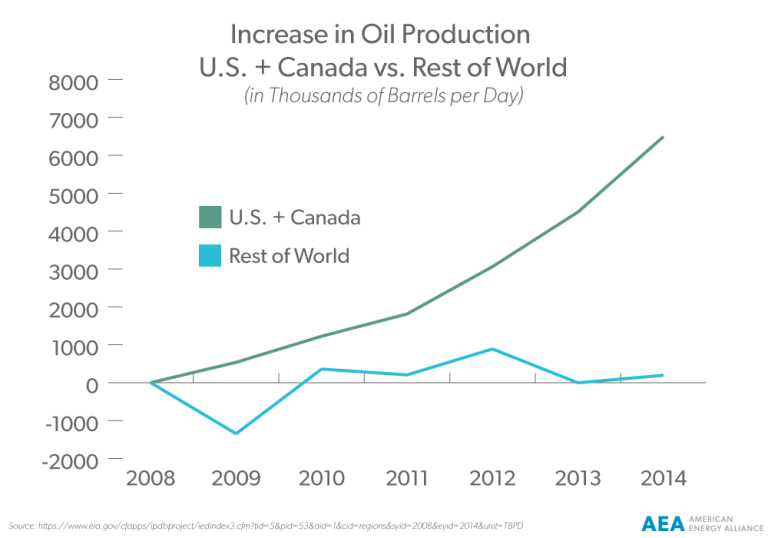

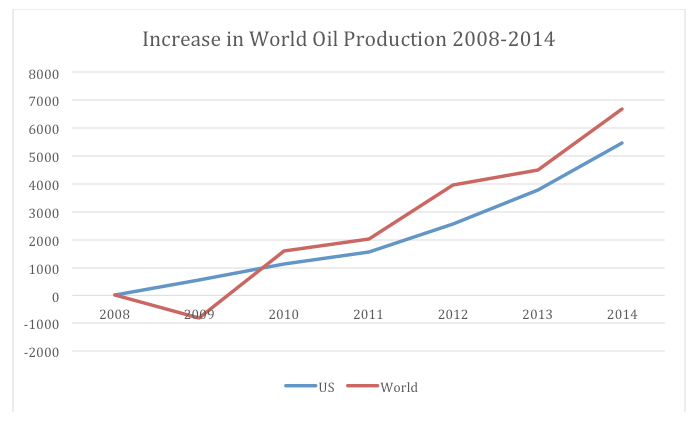

In fact, 97 percent of the total increase in world oil production came from the U.S. and Canada alone.

From 2008 through 2014 (the most recent year for which data is available), world oil production increased by 6.686 million barrels per day. 6.491 million barrels per day of that increase came from the U.S. and Canada. In fact, 5.457 million barrels a day, or 82 percent, came from the U.S. alone.

Obviously, supply is just one half of the supply and demand equation that determines the price of oil. Oil consumption has not kept up with the increases in supply, and as a result, prices have dropped. The Energy Information Administration reports that global oil inventories increased by 1.8 million barrels per day in 2015 after also increasing in 2014. Greater supply than demand equals cheaper oil.

The problem today for U.S. and Canadian oil producers is that they’ve done too good of a job of producing oil. In fact, thanks to technological advancements in hydraulic fracturing, subsurface imaging, and horizontal drilling, 95 percent of oil producers can now extract oil at $15 a barrel.

Oil prices in the low $30 range are great for American motorists, who benefit from low gasoline prices. Unfortunately, low prices can be tough for oil producers, especially smaller independent companies, who may be forced to lay off workers and delay planned investments for future oil developments.

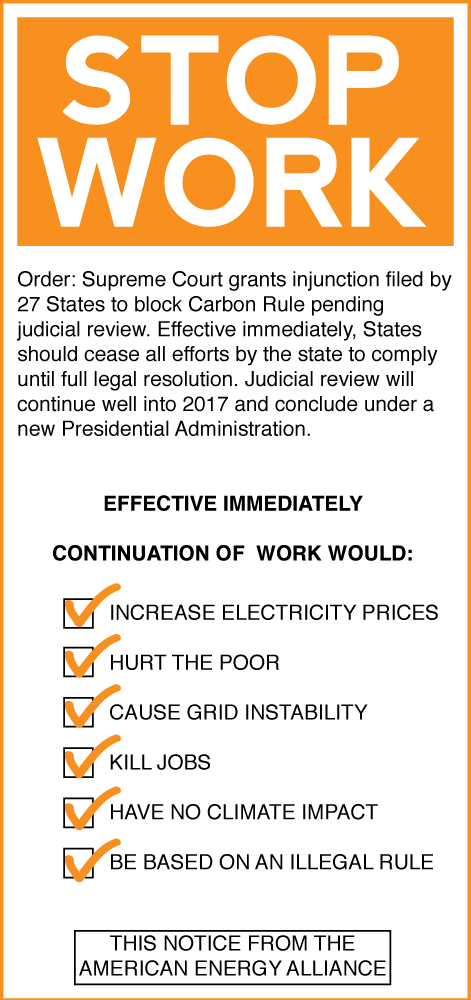

The good news out of all of this market turmoil is that Americans have proven that we can drill our way to cheaper prices for consumers – something President Obama said we couldn’t do – and that we have a lot more energy wealth than our own government would admit. The only thing that can go wrong is if the government makes it harder to produce energy, or tries to increase taxes on the energy producers and consumers that drive our economy forward.