Key Obstruction

What is the Fossil Fuel Divestment Movement?

The fossil fuel divestment movement is a group of radical activists out to convince people and institutions to divest their stock holdings in fossil fuel companies. So far, the main focus of the movement has been to get college students to pressure boards of trustees into dumping fossil fuel-related stocks from their endowments. These activists claim that the companies exploring for and producing natural gas, oil, and coal are destroying the planet, and that divesting from them is a “moral” cause.

The fossil fuel divestment movement, however, has it backwards. The morally superior choice is for people to be free to use energy to make their lives better. Today, that means having access to the abundant energy resources of coal, oil, and natural gas. Those are the technologies that lifted the developed world out of poverty, and they continue to lift millions out of poverty while they power the high-energy lives of those of us fortunate enough to live in the developed world.

Upon careful consideration of the benefits and costs to society of using coal, oil, and natural gas, it is clear that the overall impact of these technologies is hugely positive. Rather than protesting these fuels, activists who understand the big picture should praise them and the great benefits they bring to the world. Unfortunately, the divestment movement does not appear to be interested in helping to elevate humanity out of poverty or improving people’s lives. Instead, the movement is on a crusade to dismantle the technologies and products essential to modern life.

History of the Movement

Fossil fuel divestment is the brainchild of climate activist Bill McKibben. In a 2012 Rolling Stone article titled Global Warming’s Terrifying New Math, McKibben laid out his case for using dramatically less coal, oil, and natural gas (practically none). This article was also the most prominent place anyone had discussed using fossil fuel divestment as a political strategy, an idea he fleshed out in a later article.

Thus far, McKibben’s divestment strategy has focused largely on spurring action on college and university campuses. The divestment movement is geared toward campuses because, according to McKibben, “with Washington blocked, campuses are suddenly a front line in the climate fight—a place to stand up to a status quo that is wrecking the planet.”

The vast majority of University administrations, however—concerned with maintaining endowments that support everything from tuition assistance to classrooms themselves—have not given in. The leaders of Harvard, Georgetown, Tufts, Tulane, American, and Duke Universities, among others, have all rejected student groups’ calls to divest. Even though major universities are not biting, the movement does maintain a list of “commitments” on the site GoFossilFree.org, mostly from small schools, local governments, and churches. The movement is alive, but has yet to catch on with mainstream institutions.

Right now, people in the divestment movement are promoting “Global Divestment Day,” a two-day event meant to rouse collective action in support of fossil fuel divestment. The movement’s website describes the goals of the event as:

Individuals will close their accounts with banks and pension funds investing in climate chaos. University and college students will hold flash-mobs, vigils, sit-ins and rallies calling upon their endowments to invest in a liveable future. Faith leaders and people living on the frontline of climate change will band together to urge their communities to divest from climate destruction. In financial capitals, people will gather for colourful rallies calling on investors to break up with the fossil fuel industry and sever their ties once and for all.

Divestment Day is the latest ploy in a movement that, unfortunately, fails to consider the needs of the world’s poor and American families.

The Movement’s Core Beliefs

The fossil fuel divestment movement believes that coal, oil, and natural gas are destroying our planet through catastrophic climate change. The movement, however, ignores what the actual Intergovernmental Panel on Climate Change (IPCC) reports say about climate and economics. As IER’s economist Robert Murphy has explained:

[the] popular climate goal—limiting global warming to 2°C—isn’t even close to being justified by the year 2050, and even by the year 2100 cannot be justified using the scant evidence in the IPCC report. This is because—using the IPCC’s own projections—the economic costs suffered by businesses and households to comply with emissions reductions exceed the estimated environmental damages from warming.

In other words, the divestment movement is rejecting the IPCC’s climate science. Even the IPCC recognizes that energy from coal, oil, and natural gas has benefits.

Besides not trusting the IPCC, the fossil fuel divestment movement also doesn’t trust people to make their own decisions. As McKibben said in his Rolling Stone piece:

Most of us are fundamentally ambivalent about going green: We like cheap flights to warm places, and we’re certainly not going to give them up if everyone else is still taking them. Since all of us are in some way the beneficiaries of cheap fossil fuel, tackling climate change has been like trying to build a movement against yourself – it’s as if the gay-rights movement had to be constructed entirely from evangelical preachers, or the abolition movement from slaveholders.

McKibben here realizes that natural gas, coal, and oil are so useful that people will not voluntarily stop using them. In other words, people are not willing to make that tradeoff on their own when they have a clear picture of the benefits of these fuels. That’s why McKibben is attacking the companies that make these fuels—to drive up the costs so that people won’t use them anymore. The best way to do that, according to McKibben, is to polarize and demonize natural gas, coal, and oil companies.

The Fossil Fuel Divestment Strategy

McKibben is clear about his strategy, which he took straight out of Saul Alinsky’s Rules for Radicals. In fact, McKibben calls it a “fine book” and a “classic” on his blog. As McKibben wrote in Rolling Stone:

A rapid, transformative change would require building a movement, and movements require enemies… [W]e need to view the fossil fuel industry in a new light. It has become a rogue industry, reckless like no other force on Earth. It is Public Enemy Number One to the survival of our planetary civilization.

Alinsky’s book is remarkably combative, and Alinsky consistently refers to people and groups who disagree with him politically as “the enemy” and “the target.” The book uses war terminology in the ideological context. Two of Alinksy’s Rules appear to be key to the divestment strategy, which is an ideological war against companies that produce natural gas, coal, and oil.

#5: “Ridicule is man’s most potent weapon.” There is no defense. It’s irrational. It’s infuriating. It also works as a key pressure point to force the enemy into concessions.

#12: “‘Pick the target, freeze it, personalize it, and polarize it.’ Cut off the support network and isolate the target from sympathy.”

By ridiculing natural gas, coal, and oil companies as “Public Enemy Number One”—destructive of the planet itself—divestment activists try to force companies into defensive positions for which there is no defense (no one is arguing that we should destroy the planet). Further, by trying to isolate and polarize these companies, and by focusing exclusively on negative side effects, activists try to make a single enemy out of thousands of diverse businesses that provide essential energy to billions of people. Under the framework assembled by Alinsky and through his militant lens, “the fossil fuel industry” is a single, evil thing—a target to be destroyed.

There is no unitary “fossil fuel industry.” There are, however, thousands of companies and millions of individuals making decisions on what energy and how much to produce. In the U.S., those decisions resulted in about 80 percent of our energy coming from natural gas, coal, and oil in 2014. There is no “Public Enemy Number One” in reality unless that public enemy is the ability of billions of people to make their own energy decisions. It is much easier for McKibben and other divestment activists to demonize a single fictitious entity than the concept of freedom of choice. It is also incredibly disingenuous.

Divestment Activists Are Wrong: Fossil Fuels Are Good

The ability to use natural gas, coal, and oil is not “Public Enemy Number One,” nor is it even a necessary evil. Rather, it is an absolutely necessary good. After all, in the United States as we have used more of these sources, the economy has become healthier and we have reduced air pollution.

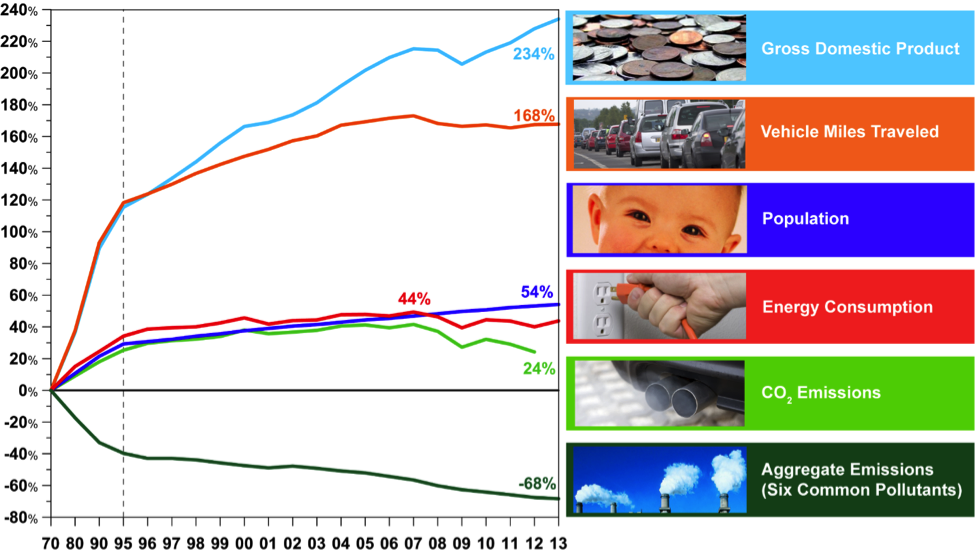

The following chart is from EPA’s Air Quality Trends Report. It shows that as the economy has grown, people have driven more, more energy has been consumed, and total pollution emissions have actually dropped. In fact, total pollution emissions are down by 68 percent since 1970 alone:

From 1970 to 2013, the consumption of energy from coal increased 47 percent, the consumption of energy from natural gas increased 23 percent, and the consumption of energy from oil increased 17 percent. Despite increased energy use from sources that divestment activists want to eliminate, air quality dramatically improved. One of the reasons for this environmental improvement is that using more natural gas, coal, and oil created greater wealth and a healthier economy, which enabled better pollution control technologies.

The world is a much better, safer, easier place to live because of the ways we have used natural gas, coal, and oil resources. McKibben and divestment activists predict climate disaster at some future date, but as noted above, they actually reject the IPCC’s reports on climate and ignore the positive trends in the environment.

In reality, far fewer people die today than in decades past from climate-related events. That is because we make ourselves safer and more resilient all the time by building better buildings, better infrastructure, better everything—and we do all of that with modern energy, the vast majority of which comes from natural gas, coal, and oil.

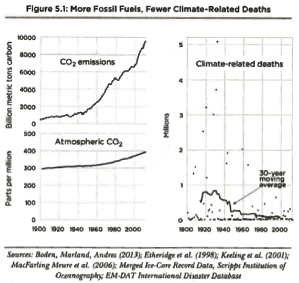

The following graph from energy expert Alex Epstein’s The Moral Case for Fossil Fuels demonstrates how the best measure of climate danger—deaths from climate-related causes—is lower now than at any point in human history as our use of natural gas, coal, and oil has steadily increased:[1]

(Source: Moral Case for Fossil Fuels, page 121)

What does this graph tell us? That the more natural gas, coal, and oil the world uses, the safer we become. This is true because building a safe civilization is an energy-intensive process that requires significant amounts of reliable energy. Having access to the best energy sources available—which are natural gas, coal, and oil in much of the world—is the best way to keep developing and keep making the world a safer, more comfortable place.

The President of Harvard University, Drew Faust, explained how important natural gas, coal, and oil products are to our lives, in his statement rejecting divestment at the university:

I also find a troubling inconsistency in the notion that, as an investor, we should boycott a whole class of companies at the same time that, as individuals and as a community, we are extensively relying on those companies’ products and services for so much of what we do every day. Given our pervasive dependence on these companies for the energy to heat and light our buildings, to fuel our transportation, and to run our computers and appliances, it is hard for me to reconcile that reliance with a refusal to countenance any relationship with these companies through our investments. [Emphasis added]

There is a reason people keeping using these energy sources. Natural gas, coal, and oil companies have been responsible for bringing light to places that were once dark, keeping schools air-conditioned in countries with severe heat stress, powering incubators that save the lives of premature children, and refrigerating food and medicine, among countless other contributions. Far from being “Public Enemy Number One,” we should acknowledge the “fossil fuel industry” for what it really is—not one evil entity but millions of individuals working for thousands of companies supplying the world with the energy people are clamoring for.

All technologies come with both benefits and costs of some kind. For example, the wind and solar industries that divestment activists tout as solutions kill hundreds of thousands of birds and bats annually and industrialize large amounts of land. Examined holistically, the benefits of natural gas, coal, and oil use overwhelmingly outweigh the costs. Divesting from these fuels means much more than simply purging one’s assets of the stocks of a few companies—it means turning one’s back on the resources that make modern civilization possible.

The Morality of Choice

Using the combative language of Saul Alinsky and the divestment movement, the real “enemy” or “target” here is the divestment movement. Activists like Bill McKibben have demonized the choices that billions of people have made in choosing reliable, affordable energy from natural gas, coal, and oil. These modern energy sources make our standard of living possible. The divestment movement is simply dead wrong about natural gas, coal, and oil. It’s as if they are morally opposed to modern life itself.

The moral alternative is the growth, prosperity, safety, environmental improvements, and overall human flourishing that comes with the freedom to use the best energy resources to improve our lives. If the divestment movement succeeded in killing “Public Enemy Number One,” it would consign billions of people to poverty and unnecessary misery. Divestment activists pretend to have the moral higher ground, but consigning billions of human beings to abject poverty is simply a morally bankrupt position. We hope their efforts fail spectacularly so we can continue improving our lives with the best energy sources available.

AEA Economist Travis Fisher authored this post.

[1] Alex Epstein, The Moral Case for Fossil Fuels, New York, NY: 2014, page 121.

Congress Should Take Steps to Repeal RFS

WASHINGTON – Today, American Energy Alliance President Thomas Pyle issued the following statement on Rep. Bob Goodlatte’s bill to reform the Renewable Fuel Standard (RFS):

“We are encouraged by Rep. Goodlatte’s effort to fully repeal the Renewable Fuel Standard. Not only is the RFS an ill-advised policy that raises food and fuel prices for American families, but the EPA has demonstrated they are incapable of administering the mandate by failing to set guidelines for both 2014 and 2015.

“Previous Congresses and the EPA have vastly overestimated the viability of advanced biofuels like cellulosic ethanol. Instead of dealing with the issue of cellulosic honestly, EPA is now fudging the numbers by redefining cellulosic ethanol to include fuel from compressed natural gas and liquefied natural gas.

“While we applaud Rep. Goodlatte for calling for full repeal, we are leery of attempts to eliminate only the corn ethanol mandate portion. The ‘corn only’ approach is not a glide path to repeal. It does little to address the heart of the problem, which is higher fuel costs and the EPA’s gross mismanagement of the RFS program. Instead, Congress should take steps toward a full repeal of the RFS.

“Eliminating only the corn ethanol mandate also does nothing to fix the issue of higher food costs. As a World Resources Institute study shows, the crops used to make cellulosic ethanol will rely on the same fertile lands that food crops rely on. A true road to repeal would include ramping down all aspects of this failed program, not just corn ethanol.”

“The only option for protecting the American people from higher fuel and food costs and an improved environment is to work toward a full repeal of the RFS. Anything less perpetuates this expensive and misguided mandate.”

Click here for a coalition letter that explains AEA’s opposition on the RFS in greater detail.

###

NY Times Global Warming Survey Misleads the Public

The New York Times recently offered up the latest in a series of surveys sponsored by media companies (and in this case executed by a believer at Stanford) purporting to show that pretty much everyone – even the dumb-dumb Republicans — wants the government to “do something” about global warming (“Most Republicans Say They Back Climate Action, Poll Finds” read here).

I thought it might be helpful to give some context and perspective to the issue.

Methodology

I know everyone gets bored with methodology pretty quickly; so do I. The Times polled adults (not registered voters, not likely voters). They weighted the results, which means they conformed them to how they think the American public is divided with respect to ideology and demography.

Priorities

This issue is at or near the top of the approximately no one’s priority list. We have been starting surveys for years by asking people: “What is the most important or pressing issue facing the United States? And what is the second most important or pressing issue facing the United States?” In ten years of asking that question, never has more than 3% of registered (or likely) voters identified environment as one of their top two issues, and a very small fragment – maybe 30 people per 10,000 respondents (or about 1/3 of one percent) – have specifically mentioned global warming. The economy, jobs, health care, the war in Iraq, debt and deficit, gas prices, etc., have all taken their turn at or near the top of the priority list (typically with 50-70 percent of the voters identifying them at one time of another as the first or second priority). But the environment has never gotten any higher than 5% combined.

Why is that important? Because most surveys simply ask respondents to select from a list (“Of the following, which do you think is an important issue facing the United States”) or, worse, ask some variation on “do you think climate change is an important issue”. These questions are not very likely to result in probative, accurate assessments of what respondents really care about, because they limit the choices the respondents can give to those selected by the survey writer. It is probably important to note that even when presented with a list, climate change routinely finishes last among the concerns of survey respondents.

The Times asked how serious a problem global warming is, without reference to other problems, so it is impossible to place the results in context.

Beliefs

We can go back and forth for a long time about what the survey data shows with respect to who believes what about global warming. But let’s make it easy. Last summer, Pew came out with survey results that indicated that about 18% of the voters simply did not believe the Earth is warming. Another 18% indicated that the Earth was warming, but did not attribute that warming to man. Another 17% indicated that we did not know enough yet to assign attribution. 40% believed the Earth is warming and man is the culprit (but it is not completely clear if that means man is entirely to blame, mostly to blame, or what). As always, about 7% did not know or refused to say what they thought.

I could pull any decent public survey from the last 15 years and the numbers would not vary by more than 5 percentage points in any direction. The simple reality is that this issue – at least since 2000 – has been marked by some short-term variations and then a return to the baseline. The baseline looks a lot like the Pew survey – about one in five hard-core believers on either side, with the remaining 60% split about evenly over time (sometimes 35-25 in one direction, sometimes 35-25 in the other).

Costs

Despite (or perhaps because of) differing sentiments about causation, there is much more coherence with respect to what voters are willing to pay to address global warming. I think we are the only ones who have consistently asked about willingness to pay as an open question (“How much are you willing to pay each year to address global warming/to reduce global average temperatures by XX/to reduce the United States’ dependence on fossil fuels?”). The responses have become fairly predictable. Means have been as high as $279 (mostly due to true believers answering “$10,000”); medians (the important measure in a democracy) have been as high as 50 to 60 dollars; and the percentage of respondents who say “zero” or “nothing” has remained pretty consistently in the low 40s.

In our most recent survey, when we asked how much respondents would be willing to pay to address global warming each year, 4 dollars was the median response (and, again, 42% answered “zero”).

The important point is that there is very limited tolerance to pay anything, even absent questions being raised about increasing the size and reach of government or giving economic advantages to our competitors.

The problem of “we”

Most people involved in public policy know that when a politician says “we”, he really means “the government”. But in most instances, our respondents understand “we” to mean “the people of the United States”. This distinction can be crucial during policy discussions, especially when it comes to federal support for something. An elected official says: “We need to support X.” The politician, of course, usually means give X some taxpayer money. But voters often think he means, “buy their product” or “get out of their way”. It is a small, but incredibly important rhetorical point, especially as we talk about renewable energy.

Conflation

Despite the best efforts of the Administration, voters do not yet conflate “doing something” on global warming with federal action. Those of us who work in policy circles routinely conflate the two; voters do not. In fact, we should clearly bifurcate “action” from “federal government action”.

Part of this rests on the idea that very few people trust the federal government to do anything well. For example, in a recent survey we asked: “Do you trust the federal government to address global warming?” Sixty percent (60%) said no; just 20% said yes.

This is important because voters expect and anticipate that if and when alternative energy becomes affordable, reliable, plentiful, and if and when global warming is addressed (whatever that means), it will happen through the application of (probably disruptive) technology and innovation, not by virtue of government regulations, mandates, and subsidies.

The Times takes full advantage of the confusion about conflation. An important question in the survey asks: “Would the United States doing things to reduce global warming in the future hurt the economy, help, or have no effect.” Imagine if the question was “would the federal government doing things help or hurt”; or “would legions of rules and bureaucrats help or hurt”. I could go on, but you get the point.

By the way, even after cooking the question, the Times could only get 42% of the respondents to say that the United States doing “things” to reduce global warming would help the economy; and that only after a series of questions focusing on how grave a problem such warming might be.

The key question

The Times offered three different takes on global warming. This one was the most popular: “I believe that global warming has been happening for the past 100 years, mainly because we have been burning fossil fuels and putting out greenhouse gasses. Now is the time for us to be using new forms of energy that are made in America and will be renewable forever. We can manufacture better cars that use less gasoline and build better appliances that use less electricity. We need to transform the outdated ways of generating energy into new ones that create jobs and entire industries, and stop the damage we’ve been doing to the environment.”

Wow. The other two options were essentially strawmen. This one, of course, is a perfect example of the problem of “we”. “Now is the time for us to be using new forms of energy.” Again, imagine if they had asked whether now is the time for new federal mandates to use new forms of energy. “We need to transform the outdated ways of generating electricity . . .” Imagine if they had asked whether the federal government should transform the electricity system. Actually, we did ask that in a survey a few months back and about two-thirds of the voters rejected the idea.

You get the point. The survey drove respondents to this answer. It doesn’t tell us anything that we didn’t already know – people like technology, they like a clean environment, they like better cars and appliances, they like new jobs and industries. The survey is silent on the questions of the day – how much should the federal government be involved in energy? How much are people willing to pay to change the way we make and consume energy? What do people think are the best ways to make the changes they want?

I had hoped for better from the Times and Stanford.

Other questions

When they did get around to asking about the federal government, the Times could not resist an editorial preface. Here’s the question: “As you may have heard, greenhouse gases are thought to cause global warming. Should the federal government limit the amount of greenhouse gases that U.S. businesses put out?” In other words, there is a problem, would you like someone else to take care of it? Not a shocker, 78% of the respondents like free stuff.

But when it turned to what the respondents were willing to offer, the wallets got a little tighter. Just 25% favored increased taxes on electricity (I wonder how they would feel about a renewable mandate that acts as a tax); and 35% favored taxes on gasoline. I’m not sure where those taxes would go, although I suspect if we asked, “would you a favor an increase in the federal gasoline tax?” we would get fewer than 35% of respondents supporting the idea.

Final thoughts

Three final thoughts are worth noting.

First, the science is coming our way. One by one the narratives on the other side are being discredited or simply overtaken by events. Think about polar bears, or droughts and hurricanes, or sea level rise, or global average temperatures. Even the most recent IPCC report, read in its entirety, injects considerably more uncertainty into the discussion. As improbable as it seems, the Washington Post recently ran a blog delving into the “pause” in the increase of global average temperatures. Each of the IPCC models has been wrong in its entirety; climate sensitivity is much lower than anticipated.

Second, other nations are coming our way. Australia has gotten rid of its carbon tax. The Japanese have indicated they have bigger fish to fry than global warming. The Germans are about to give up on their green experiment and will use more coal this year than last, and will use more next year than this year. India recently said flat out that economic growth was more important than global warming.

Third, as discussed above, public opinion continues to wash around a few simple numbers – it has been fairly static for a long time.

You can make whatever decisions are appropriate for your company or your boss or what have you; I hesitate to tell people what to do. But the counsel should at least be based on good information. The information we have available to us – opinion research and science — suggests that we are winning this fight. It is probably premature to talk about exit strategies.

One last thought. Those who are advocating a rework of messages and policies with respect to global warming are, almost without exception, the same people who have been encouraging a series of preemptive surrenders since the Bush Administration. There were numerous people, especially among the utilities, who wanted to make a deal with Jim Connaughton and his crew in 2007 and 2008. They then migrated onto Waxman-Markey. Now they are wetting the bed over the proposed existing source rule.

This post was authored by Mike McKenna, President of MWR Strategies. McKenna has conducted public polling research for AEA.

Sen. Schumer Opposes Job-Creating KXL, Supports Job-Killing Wind Subsidies

Amid last week’s fierce Senate debate over the Keystone XL pipeline bill, Sen. Chuck Schumer of New York made light of the economic benefits of the pipeline when he said, “The fact is that the Keystone would create only 35 permanent jobs—a drop in the bucket. A fried chicken franchise creates about as many jobs.”

Schumer’s statement is economically illiterate, especially when you pair it with his support of Sen. Heitkamp’s amendment to extend the wind Production Tax Credit (PTC) for five years. He has a problem with a private project that creates jobs and generate tax revenue, but he supports massive public subsidies through the PTC that reduces the number of jobs overall.

Jobs, Jobs, Jobs for Oil Carriers!

Schumer “only 35 permanent jobs” argument is a favorite of those in opposition to Keystone XL. Schumer apparently believes that the more jobs a project creates, the better as opposed to asking whether a project makes economic sense. This is lunacy. For example, just think of how many jobs would be created if people physically carried the oil from Hardisty, Alberta to Cushing, Oklahoma. Millions of jobs could be created!

The Keystone XL will carry 830,000 barrels of oil a day. A barrel of oil is 42 gallons, so that’s 34,440,000 gallons a day. If a gallon of oil weighs 7 pounds and a person can carry 50 pounds that means it would take 4,800,000 people to carry the oil the Keystone XL would carry every day. According to Sen. Schumer’s logic, we shouldn’t use a pipeline, but instead TransCanada should hire 5 million people to carry oil! All our job problems would be solved!

It is obvious that this example is silly, but it illustrates Sen. Schumer’s logic. It isn’t a bad thing that the pipeline would only employ 35 people—it’s a great thing. This is how the free market works—it means that instead of millions of people carrying oil from Canada that the work is done by a mere 35 people. This frees up people to create value and be productive elsewhere in the economy. It does not make sense to hire people to carry oil when there are cost effective alternatives.

At Least the Keystone XL Creates Jobs—Unlike the Wind Production Tax Credit

But the wind PTC is different. With the Keystone XL, the TransCanada isn’t asking the federal government for a multi-billion dollar handout. All they are asking for a permission to cross the border. The wind PTC is multi-billion dollar handout and even Sen. Schumer should understand that multi-billion dollar handouts don’t come free.

The wind PTC does not create jobs on net, compared to an alternative policy in which the federal government refrains from using the tax code to pick winners and losers. Although the proponents of the PTC such as the American Wind Energy Association claim that failing to reauthorize the tax credit would “kill jobs,”[1] the money used to subsidize those jobs comes from taxpayers, not from thin air.[2] Rather than arbitrarily limiting tax credits to wind producers, generally returning the money to taxpayers would have “created jobs” as well—jobs that produce goods and services that Americans actually want. As we have pointed out:[3]

“At the end of last year [2012], the federal wind production tax credit was extended for another year. According to the Joint Committee on Taxation, this one-year extension of the PTC would cost $12.1 billion. The American Wind Energy Association, the lobby for the wind industry, claims that 37,000 jobs would have been lost if the PTC was not extended. This means that each job “saved” cost the U.S. Treasury $327,000. While the PTC…might “create” some identifiable jobs, they do not create jobs “on net.”

The money to pay for the PTC has to come from somewhere. In other words, if taxpayers were able to keep the money instead of it going to subsidies, the taxpayers would have spent the money and that spending would have created other jobs.

The question isn’t whether the PTC “creates jobs”—it’s whether it creates more jobs than it takes away from the rest of the economy. In Spain, for example, where the government pushed “green energy subsidies” aggressively, 2.2 jobs were lost for every “green job” that the subsidies supported.[4] This is why the PTC is not a job creator—the money has to come from somewhere.

35 Permanent Jobs is Greater than Jobs Destruction Caused by the PTC

The Senate’s Keystone bill is an attempt to authorize a privately funded project that has been waiting on federal approval for over six years. The pipeline would create thousands of jobs, strengthen the economy, and deliver affordable and reliable energy without relying on support from the federal government. The PTC amendment, on the other hand, was nothing more than an attempt to extend a taxpayer-funded handout to the wind industry. An extension of the PTC would cost taxpayers billions of dollars, raise electricity rates, and do little to create jobs for Americans.

If Sen. Schumer truly wants to put more Americans to work and strengthen our economy, he should spend less time blocking Keystone XL and more time cutting costly handouts like the wind PTC.

AEA Communications Director Chris Warren contributed to this post.

[1] AWEA, Federal Production Tax Credit for Wind Energy, http://www.awea.org/Advocacy/content.aspx?ItemNumber=797

[2] Strictly speaking, there is an important distinction to be made between a business receiving a reduction in its tax liability versus receiving an explicit subsidy check funded by other taxpayers. However, in practice this distinction is not very relevant for the PTC, because many projects use sophisticated financial maneuvering in order to offload the tax credit from the actual operation onto outside investors, effectively auctioning off the tax credit. This type of maneuvering is necessary because the operation in question doesn’t have a high enough tax liability to take full advantage of the PTC. That’s why so many environmentalists are pushing to make the PTC refundable, which would turn it into an outright welfare program for renewable power. See http://www.renewableenergyworld.com/rea/blog/post/2012/04/refundable-federal-tax-credit-could-remove-barrier-to-community-wind.

[3] Daniel Simmons, Testimony before the Ohio Senate Public Utilities Committee, American Energy Alliance, November 13, 2013, https://www.americanenergyalliance.org/wp-content/uploads/2013/11/Simmons-Testimony-for-Ohio-Public-Utilities-Committee-SB-58.pdf.

[4] Gabriel Calzada Alvarez, Study of the effects on employment of public aid to renewable energy sources, Universidad Rey de Juan Carlos, March 2009, http://www.juandemariana.org/pdf/090327-employment-public-aid-renewable.pdf.

Introduction to Fossil-Fuel Divestment

Energy is the lifeblood of modern society, but there is a new movement to halt our use of energy and the products of modern life as well—the fossil-fuel divestment movement. These activists seek to pressure individuals and institutional investors to “divest” of stocks, bonds, and other investments in natural gas, oil, and coal companies. This morally bankrupt movement is trying to keep billions of people in poverty, deny people access to energy, and forbid access to the lifesaving products that come from coal, natural gas, and oil—including steel, plastics, and pharmaceuticals.

Divestment Threatens Modern Life and the Potential to Achieve a Better Life

The energy we use in every day life comes from a variety of sources, but some play a bigger role than others. Natural gas, oil, and coal—the sources of energy the divestment movement wants to divest from—make up 82 percent of all the energy Americans use. Two-thirds of the electricity we use comes from coal and natural gas, and 95 percent of our transportation fuels come from petroleum.

While most Americans have access to energy, according to the International Energy Agency, “globally over 1.3 billion people are without access to electricity and 2.6 billion people are without clean cooking facilities.” Natural gas, coal, and oil offer some of the most cost-effective ways to expand energy access for these people. But the divestment movement wants people to divest from these energy companies, making it more difficult to expand energy access to the poorest of the world’s poor.

But it’s not just about energy. Coal, oil, and natural gas are used for far more than just energy. Besides generating electricity and providing heat for people’s homes, natural gas is used to make fertilizer, pharmaceuticals, plastics, fabrics, and many more products. Besides generating electricity, coal is used to make steel, concrete, soaps, aspirins, plastics, carbon fiber, and more. Besides creating transportation fuel, oil is used to make chemicals, plastics, asphalt, lubricants, wax, and much more.

By urging people to divest from the stocks of natural gas, coal, and oil companies, the divestment movement is not only trying to divest people from the energy from these sources, but from the products as well. For instance, the naïve might think that divesting from coal stocks only means ending coal for electricity generation, but it also means divesting from stainless steel as well. This means divesting from stainless steel water bottles like the Klean Kanteen.

Divesting also means that our roads will worsen because it means divesting from the companies that produce not only asphalt, but also concrete. And how will bridges be built without steel?

Divestment also means divesting from carbon fiber—so no more high-tech bicycles. It also means no more polyester and nylon, such as is used in Patagonia’s outdoor gear, which comes from natural gas. The list goes on.

In other words, divestment activists want us to turn our backs not only on the energy we use in every day life, but on the steel, plastics, carbon fiber, and other products of modern civilization as well.

Scale of Global Energy Demand

Taken to its logical conclusion, divesting from natural gas, oil, and coal would consign billions of people around the world to a lifetime of poverty. The world’s energy needs are vast and growing: global energy demand is expected to rise 37 percent by 2040, while 1.3 billion people around the world currently lack access to electricity. The world needs more energy, but divestment activists demand us to use less energy, or at least less of the only sources of energy that can meet our needs. That is a recipe for energy poverty.

Looking Ahead

In less than two weeks, divestment activists will hold a “Global Divestment Day” to push their radical cause. It’s why the American Energy Alliance has launched this Divestment Tracker to highlight the benefits of traditional energy sources and the threat posed by divestment activists. Although “Global Divestment Day” (or perhaps more aptly, “Energy Poverty Day” or “Stone Age Day”) will come and go, divestment activists and their harmful philosophy are not going away quietly.

That’s why, in the coming days, AEA will be providing a series of educational articles related to the divestment movement. Forthcoming topics include: explaining the positive role of natural gas, oil, and coal to every day life; assessing the claims, history, and goals of divestment activists; and highlighting the scale of global energy demand. We hope this page can serve as a useful resource for anyone who wants to fight for energy freedom. Stay tuned!

Blocking Off ANWR in One Map

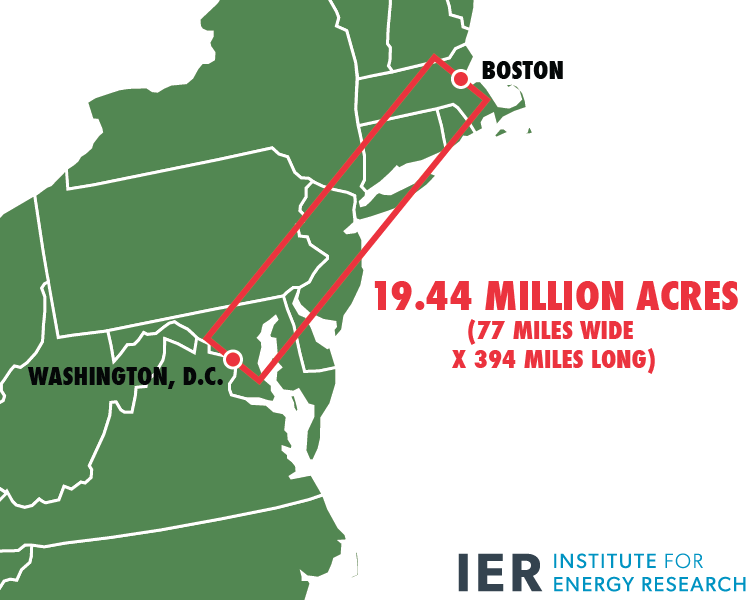

The following map, from the Institute for Energy Research, shows how much land would be off-limits if Obama’s proposed ANWR wilderness plan (12.28 million acres) were added to existing ANWR wilderness areas (7.16 million acres). That would cover a strip of land extending the length of D.C. to Boston that is 77 miles wide:

President Obama’s wilderness proposal is less about protecting ANWR than preventing energy development. It is part of a larger effort to starve the Alaska Pipeline, which is operating at just one-quarter of total capacity despite the state’s vast energy resources. Alaskans deserve better.

Do the Feds Know How Big ANWR Is?

The Interior Department announced a proposal this week to designate 12.28 million acres of the Arctic National Wildlife Refuge (ANWR) as wilderness. In a White House video, President Obama claimed a wilderness designation would “make sure that this amazing wonder is preserved for future generations.” But it seems the federal government doesn’t even know the actual size of the “amazing wonder” it wants to preserve.

The Fish & Wildlife Service (FWS) lists at least three different acreage estimates for ANWR, with a range of 500,000 acres. That discrepancy is equivalent to misplacing more than 11 cities the size of Washington, D.C.[i] This begs the question: if the feds don’t know how big ANWR is, are they really its best stewards?

FWS: ANWR is 19.3 Million Acres

Consider the following screenshot in which FWS claims ANWR is 19.3 million acres. It can be found in a section of the FWS website titled “Facts & Features”:

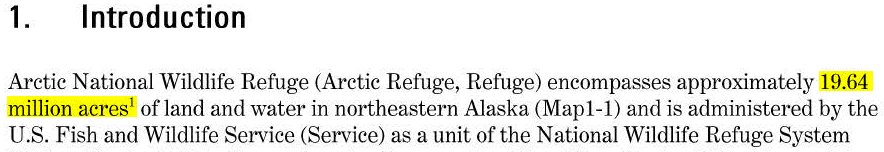

FWS: ANWR is About 19.64 Million Acres

FWS: ANWR is About 19.64 Million Acres

Now consider this next screenshot. We found it in the first chapter of FWS’s new draft ANWR Comprehensive Conservation Plan. Here FWS claims that ANWR is not 19.3 million acres, but actually 19.64 million acres. For context, the difference between those two figures is like losing an area of land the size of New York City[ii]:

Careful readers will notice the footnote in the above screenshot. The footnote informs readers, “Acreages in this Plan are derived from many sources and may not agree with previously published values.” In other words, the people tasked with protecting ANWR don’t even agree on how big ANWR actually is.

Interior Department: ANWR is 19.8 Million Acres

The disagreement only deepens with the Department of Interior’s press release announcing the Comprehensive Conservation Plan. The press release claims that ANWR is neither 19.3 million acres nor 19.64 million acres, but actually 19.8 million acres—or 500,000 more acres than the lowest estimate from FWS’s “Facts & Features” page:

FWS now says ANWR is 19.64 Million Acres

FWS now says ANWR is 19.64 Million Acres

FWS states in its recent planning update that “the size of the Refuge was previously published as 19.3 million acres but is listed in the Revised Plan as 19.64 million acres.” But this still begs the question: why does Interior’s press release claim ANWR is 19.8 million acres?

Oil Production Would Require Just 2,000 Acres

In 1980, Congress set aside 1.5 million acres of ANWR for future study of its energy resource potential, known as the “1002 Area.” The U.S. Geological Survey estimates that ANWR’s 1002 Area, which the administration’s proposal would put off-limits, has an expected value of 10.4 billion barrels of recoverable oil that could be produced at a rate of about one million barrels of oil per day.[iii]

Energy resources in the 1002 Area could be developed using merely 2,000 acres, or less than 0.01 percent of ANWR’s total area.[iv] Regardless of the size of ANWR, the FWS’s inability to figure out the size within 500,000 acres makes us wonder: what’s wrong with allowing energy production on a mere 2,000 acres?

Click here to read IER’s fact sheet on ANWR.

[i] Washington, D.C. is 43,712 acres. See http://www.census.gov/geo/maps-data/data/gazetteer.html

[ii] New York City is approximately 300,000 acres. See http://www.census.gov/geo/maps-data/data/gazetteer.html

[iii] U.S. Geological Survey, Arctic National Wildlife Refuge, 1002 Area, Petroleum Assessment, 1998, Including Economic Analysis (April 2001), http://pubs.usgs.gov/fs/fs-0028-01/.

[iv] Energy Information Administration, Potential Oil Production from the Coastal Plain of the Arctic National Wildlife Refuge: Updated Assessment, 3. Summary, http://www.eia.doe.gov/pub/oil_gas/petroleum/analysis_publications/arctic_national_wildlife_refuge/html/summary.html. See also, Arctic Power, Top 10 Reasons to Support Development in ANWR, http://www.anwr.org/topten.htm.

New Report Calls Out EPA’s Junk Science

Energy In Depth released a new report Wednesday that questions the scientific data EPA uses to justify its proposed ozone rule—which could be the costliest regulation in U.S. history.

One interesting finding in EID’s survey of the literature is that EPA’s ozone rule could actually increase asthma-related mortality, even though the agency cites reducing asthma attacks as one of the major benefits of the rule. As EID explains:

The EPA cites “asthma attacks” as one of its key health indicators, suggesting that imposing a stricter ozone standard would reduce asthma attacks, and thereby delivering health benefits. But as noted by the Center for Regulatory Solutions — a project of the Small Business & Entrepreneurship Council — EPA’s own documents show that asthma-related mortality could increase in certain areas if ozone levels decrease.

[…]

[Dr. Michael] Honeycutt looked at EPA’s own data sets and found that, in Houston, adjusting the ozone standard to 70 ppb or 65 ppb would result in 48 or 44 more premature deaths, respectively. The reason for this counter-intuitive conclusion is anyone’s guess, ranging from flawed data analysis to an acknowledgment that less economic opportunity can worsen individuals’ health.

To read the rest of EID’s report, click here.

To read IER’s analysis of EPA’s proposed ozone rule, click here.