A forthcoming report claims that a foreign firm funding U.S. environmental groups opposed to America’s domestic energy boom is tied to a state-owned Russian oil company with a financial interest in halting U.S. energy production. As The Washington Free Beacon reports:

A shadowy Bermudan company that has funneled tens of millions of dollars to anti-fracking environmentalist groups in the United States is run by executives with deep ties to Russian oil interests and offshore money laundering schemes involving members of President Vladimir Putin’s inner circle … No one knows where that firm’s money comes from. Its only publicly documented activities have been transfers of $23 million to U.S. environmentalist groups that push policies that would hamstring surging American oil and gas production, which has hurt Russia’s energy-reliant economy.

The “shadowy Bermudan company” is called Klein Ltd. Klein funds a group called Sea Change, an environmental bundler which has donated millions of dollars to groups like Sierra Club, the Natural Resources Defense Council, and the League of Conservation Voters. Each group supports policies designed to undermine domestic oil and gas development, including bans on hydraulic fracturing.

According to the Environmental Policy Alliance, Sea Change is run by hedge-fund millionaire Nathaniel Simons and his wife, who along with Klein Ltd are Sea Change’s only donors. Mr. Simons supposedly “commutes to work across San Francisco Bay aboard a 50-foot yacht, also runs a venture capital firm that invests in companies that benefit from environmental and energy policies that Sea Change grantees promote,” as reported by the Free Beacon.

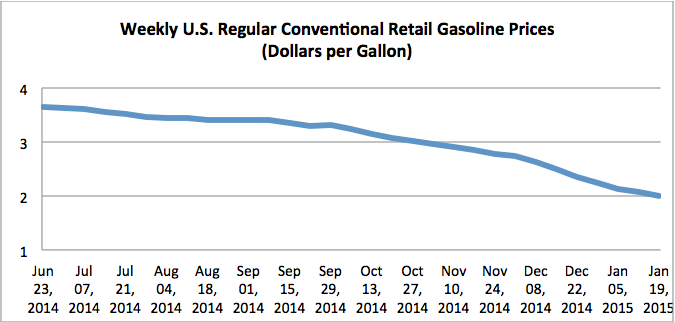

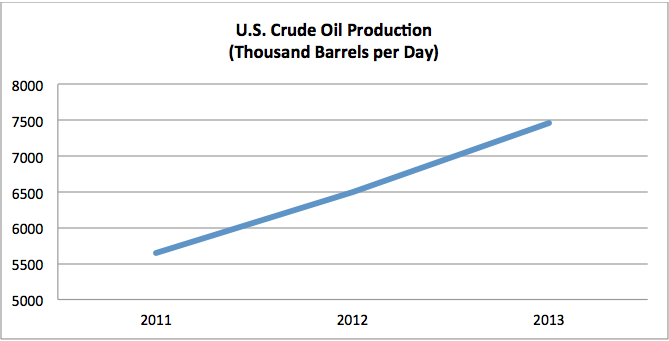

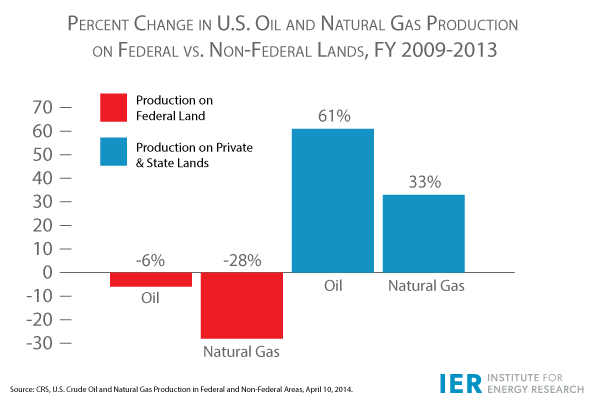

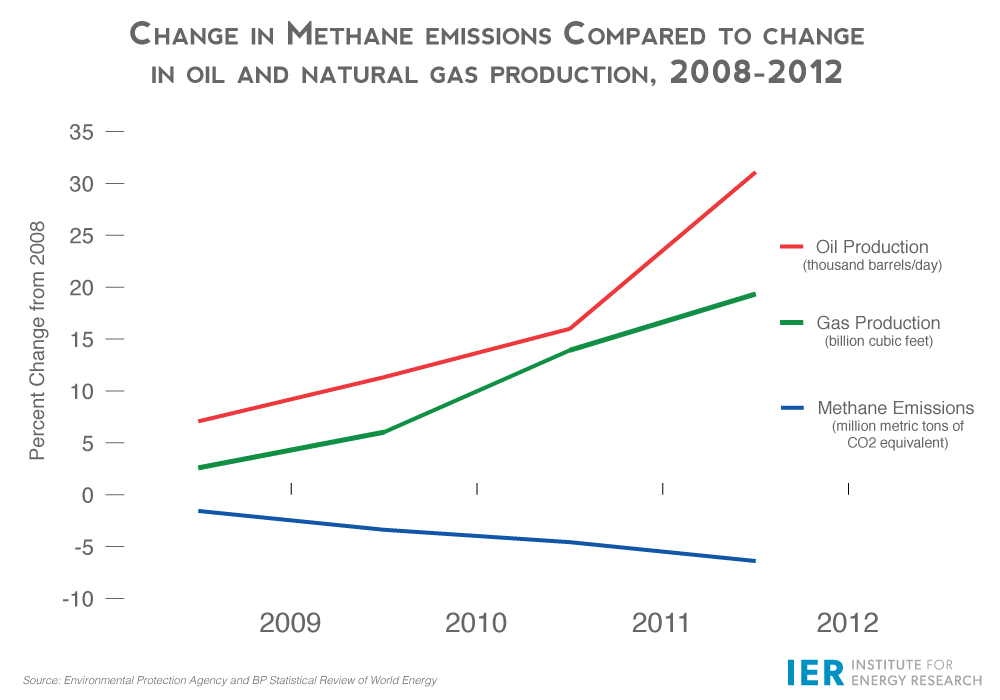

This news shouldn’t surprise anyone. The Russian government has a major financial interest in seeing America produce less energy. The U.S. is now the world’s largest combined oil and natural gas producer, recently eclipsing Russia and Saudi Arabia. Booming U.S. oil production has sent oil prices tumbling—that benefits American families in the form of lower gas prices. It also means less money for the Kremlin, which is heavily dependent on oil and natural gas revenues to fund its government.

Our energy boom also enhances our national security. We could unleash our enormous supplies of oil and natural gas to help our European allies fight back against petro-states like Russia that use energy as a geopolitical weapon. Unfortunately, the Obama administration is slow-walking liquefied natural gas (LNG) permit applications that would allow us to export natural gas to Poland, Ukraine, and other allies currently besieged by Putin and dependent on Russian gas supplies.

Fortunately, some in Congress want to force the administration to act. This week, the House is expected to pass a bill to force the Department of Energy to expedite LNG export applications. The American Energy Alliance supports the bill and issued a key-vote alert urging passage. It represents a tangible step Congress can take to counter Russian aggression against U.S. interests, which is particularly relevant given new allegations linking Russian oil interests to national environmental groups..