Just in time for Christmas, the jolliest podcast hosts you know, Tom Pyle and Mike McKenna, unveil their inaugural holiday special.

Links:

Thanks for joining the AEA efforts to help combat rising energy prices. We don’t want to bug you that often, so let us know what energy issues interest you, and we’ll keep your inbox happy.

Just in time for Christmas, the jolliest podcast hosts you know, Tom Pyle and Mike McKenna, unveil their inaugural holiday special.

Links:

On December 8, President Biden directed federal agencies to cut the government’s carbon dioxide emissions by 65 percent by 2030 with the goal of reaching net-zero emissions by 2050. Biden is directing federal car shoppers to buy only zero-emission passenger vehicles and light trucks by the end of fiscal year 2027, with 100 percent compliance by all vehicles by 2050. His executive orders call for federal buildings to transition to net-zero emissions by 2045, by primarily powering the facilities with wind, solar, and nuclear energy and using “sustainable” building materials. By 2030, Biden wants the federal government to purchase electricity produced only from sources that do not emit carbon dioxide. By 2032, the Biden administration wants to see carbon dioxide emissions from building operations, such as heating, cut in half.

In a series of executive orders, Biden directed the government to transform its 300,000 buildings, 600,000 cars and trucks, and use its annual purchases of $650 billion in goods and services to meet his goal of a federal government that is net zero in carbon dioxide emissions by 2050. The plan does not cover purchasing by the Department of Defense, which accounts for a large portion of the government’s energy spending.

Issues

Currently, only 40 percent of the electricity purchased by the federal government of its $4.5 billion in electricity expenditures annually comes from renewable sources like wind and solar. Biden’s goal is to ramp that up to 100 percent in less than a decade. The federal government consumes just 1.5 percent of the nation’s energy, although it is a major player in certain states where it has significant operations, such as Virginia, California, Georgia and North Carolina. In converting its power to wind, solar and other sources that do not produce carbon dioxide emissions, the government intends to follow the path set by companies like Google, Apple and Wal-Mart, which established tariffs or developed power-purchase agreements with local utilities to achieve their goals of 100 percent renewable energy.

Currently electric vehicles represent only about 1.5 percent of the government fleet. In fiscal year 2021 the administration purchased 650 electric vehicles, but that number would have to increase several-fold this year and beyond to achieve the goal. The government buys about 50,000 vehicles a year, many of which are replacements. Renewable energy and other “clean” energy purchases are likely to cost the government more money, and many of the components like electric charging stations for an all-electric federal vehicle fleet have not yet been built and will also run up the price tag of achieving Biden’s goals.

According to the White House Fact Sheet, the following acquisitions will begin the effort toward meeting the goals:

These are just a drop in the bucket to what will be needed to attain Biden’s goals.

Conclusion

These executive orders are to get the Biden administration closer to its announced goal of cutting U.S. greenhouse gas emissions 50 percent to 52 percent below 2005 levels by 2030. The White House plans to use money from the $1.2 trillion infrastructure bill, the annual budget and the Build Back Better Act, which Congress has yet to pass, to pay for these federal initiatives, which will harm workers in the fossil fuel industries. While Biden’s goals will be creating jobs in the renewable energy and electric vehicle markets, these jobs will not compensate for the losses in the fossil fuel industries and their higher salaries. Luckily, given that these goals are set by executive order, they can be reversed by a future administration more concerned about financial responsibility to taxpayers.

*This article was originally published by the Institute for Energy Research.

On this episode of The Unregulated Podcast Tom Pyle and Mike McKenna discuss Democrats’ crazy attempts at inflation deflection and nail down what exactly is causing the consumer price index to skyrocket.

Links:

One of the President’s most important jobs is to “take Care that the Laws are faithfully executed” as it says in Article II Section 3 of the Constitution. Put another way, an important purpose of the Executive Branch is to execute the laws. The Department of Energy, however, does not want to do that with research and development on oil, natural gas, and coal. In fact, they have gone so far as to say that it is “a central ethic of our [Fossil Energy] office is that if a non-fossil energy option exists today, it should always be preferred to the use of fossil energy.”

In July 2021, the Biden administration changed the name of the Fossil Energy Office at the Department of Energy from the Office of Fossil Energy to the Office of Fossil Energy and Carbon Management (FECM). There is nothing wrong with changing the name of the office and there is nothing wrong to note that part of the work the office does is “carbon management.” The problem is that they would like to ignore their statutory instructions—the law—in the name of climate change.

On December 6, 2021, the Office posted an explanation of their name change. They wrote, “This is not a rebranding; it is a historical shift in focus.” The problem is that this gets it exactly wrong. The Department of Energy is free to rebrand the office, but they are not free to shift focus or execute their own goals. Congress writes the laws explaining the focus and goals and then the Executive Branch executes those directives.

But the Biden administration doesn’t want to execute the law as it is written, but rather to make up their own statutes to execute. For example, DOE writes, “we have refocused FECM to center our work on climate.” The problem is that Congress has not authorized DOE to “center their work on climate.” There is no statutory authorization to only focus on climate. DOE’s work on fossil energy is authorized by 42 U.S.C. 16291. It instructs DOE to work on improving energy from fossil energy including reducing greenhouse gas emissions. For example, here is part of the office’s objectives:

(2) Objectives

The programs described in paragraph (1) shall take into consideration the following objectives:

(A) Increasing the energy conversion efficiency of all forms of fossil energy through improved technologies.

(B) Decreasing the cost of all fossil energy production, generation, and delivery.

(C) Promoting diversity of energy supply.

(D) Decreasing the dependence of the United States on foreign energy supplies.

(E) Improving United States energy security.

(F) Decreasing the environmental impact of energy-related activities, including technology development to reduce emissions of carbon dioxide and associated emissions of heavy metals within coal combustion residues and gas streams resulting from fossil fuel use and production.

… [emphasis added]

Congress instructed the Department of Energy to work on reducing GHGs from fossil energy, but that is only part of a list of things they are supposed to work on, not the only focus. The Department of Energy is also supposed to work on decreasing the cost of oil, natural gas, and coal production for Americans. But the Department of Energy would like to ignore that.

One of the most concerning things in DOE’s statement is its rejection of fossil energy overall. The original version of the statement posted on DOE’s website states, “a central ethic of our [Fossil Energy] office is that if a non-fossil energy option exists today, it should always be preferred to the use of fossil energy.” This statement was apparently a little too honest because DOE edited the statement and removed that sentence. But that sentence is certainly the spirit of the statement as a whole.

The statement also talks about climate goals, net-zero goals, and decarbonization goals. The problem with these goals is that Congress has not set them. Again, Congress has legislative power and the Executive Branch is supposed to execute the law, not extra-statutory goals of temporary office-holders with personal beliefs.

With this rebranding and refocusing, DOE is thumbing their noses at Congress and our very form of government with its divided roles. It is critical that Congress forces DOE to focus on its statutorily defined mission and not allow DOE to ignore the law.

*This article was originally published by the Institute for Energy Research.

On this episode of The Unregulated Podcast, Tom Pyle and Mike McKenna discuss this week’s headlines and the arrival of an unexpected ally in the fight against Biden’s Build Back Beter.

Links

On this episode of The Unregulated Podcast Tom Pyle and Mike McKenna discuss this week’s wildest headlines.

Links:

On November 19, the House of Representatives passed a $2 trillion budget bill with a long list of increases in federal royalties and fees, plus new fees, new taxes, and barriers to leasing in the Arctic National Wildlife Refuge, the Pacific, Atlantic, and eastern Gulf of Mexico. It passed on a party-line vote of 220-213 and was sent to the Senate, where changes are expected. It contains a long list of higher costs for oil and gas companies, especially those operating on federal lands. The arbitrary new fees would add millions of dollars in operating costs, pricing out U.S. production. This bill taxes American energy, restricts access to resources owned by Americans and advances ‘import-more-oil’ strategy that the Biden administration has been promoting—all of which will cost Americans more to heat their homes with natural gas and fill their tanks with gasoline.

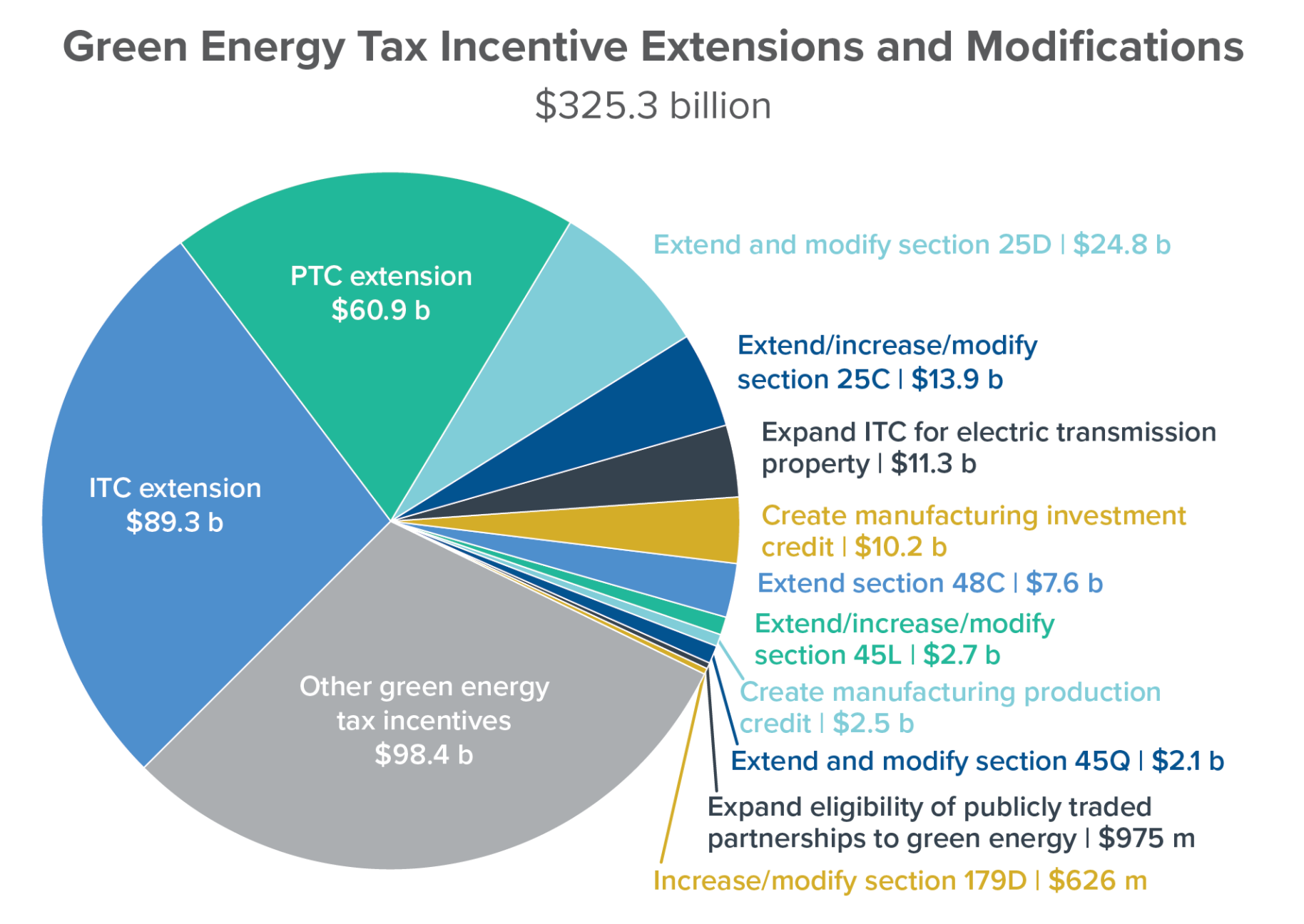

On the other hand, the bill contains some $300 billion in spending for renewable energy—by far the largest component of the climate spending in the package. It would expand tax credits for renewable power, electric vehicles, biofuels and energy efficiency. The credits could accelerate investments in both utility-scale and residential renewable energy as well as electricity transmission, power storage and “clean-energy” manufacturing. Thus, the bill uses taxpayer funds to promote “green” causes that cannot efficiently and affordably supply energy to the American public.

Build Back Better Act Attacks the Oil and Gas Industry

The bill ups the royalty rate for all new onshore oil and gas leases on federal lands to 18.75 percent, up from the 12.5 percent minimum currently. For offshore, the minimum would be 14 percent, and the policy option of royalty relief for economic reasons would be terminated.

Royalties for natural gas would cover all natural gas, including gas vented, flared, or leaked from onshore and offshore operations in the upstream, with an exception only for 48 hours of emissions during an emergency.

Onshore minimum bids and rental rates would increase, and the primary term for onshore leases in the 48 contiguous states would be limited to 5 years. An “expression of interest fee” of $15 to $50 per acre would be added to Department of Interior costs.

A new annual “conservation of resources fee” would be set at $4 per acre onshore and offshore, and a new annual “speculative leasing fee” would be set at $6 per acre for new nonproducing leases. No noncompetitive leasing would be permitted. Bonding to cover potential costs would need to be updated by Interior.

Offshore inspection fees are specified, while onshore inspection fees would be required from the Department of Interior. A severance fee would be collected by Interior at a rate of $0.50 per barrel of oil equivalent produced.

An annual fee would be levied for “idled” wells—idled for at least 2 years—and for which there is no anticipated beneficial future use.

An annual fee would be imposed on offshore pipeline owners: $1,000 per mile in waters less than 500 feet deep and $10,000 per mile in deeper waters.

The leasing program for the coastal plain of the Arctic National Wildlife Refuge would be repealed, and all payments made for leases would be returned to lessees. New exploration and production would be barred in the Pacific, Atlantic and eastern Gulf of Mexico—a codification of what has been the status quo for many years.

A new methane “waste emissions charge” would apply to all onshore and offshore oil and gas exploration and production work, as well as oil and gas gathering lines, upstream and midstream gas pipeline transmission, gas pipeline compression, onshore gas processing, underground storage, liquefied natural gas storage, and LNG import and export equipment. In other words, it will not just apply to operations on federal lands. The fee would be $900 per ton for methane emissions in 2023, $1,200 in 2024, and $1,500 thereafter. For production sites, the new fee would apply to emissions that exceed two-tenths of 1 percent of the natural gas sent to sale, though an alternative calculation also is provided. For natural gas transmission, upstream from retail utility operations, the fee would apply to emissions that exceed 0.11 percent of the gas sent to sale.

At the COP26 meeting in Scotland, the United States announced it will participate in the Global Methane Pledge to cut methane emissions 30 percent by 2030.The methane fee in the Build Back Better bill is part of Biden’s commitment to reach that goal. But, two of the world’s biggest methane emitters — China and Russia — refused to sign the Global Methane Pledge. Here again Biden wants to use Americans as examples without concern about what the financial outcome would be to American energy expenses.

Renewable Energy Benefits

The proposed bill includes a variety of renewable energy tax incentives. It would structure various credits as tiered incentives, providing either a base rate or a bonus rate of five times the base amount for projects that meet certain prevailing wage and apprenticeship requirements. An additional increased credit amount could be claimed in certain cases if projects comply with domestic content requirements, such as ensuring that any steel, iron, or manufactured product was produced in the United States.

The production tax credit (PTC) for energy facilities that produce electricity from renewable energy sources would be extended through 2026 and increased for facilities in energy communities where a coal mine or a coal-fired electric generating unit has been shut down. The PTC for solar facilities would also be reinstated through 2026. The investment tax credit would be extended through 2026 for most property and increased for projects in energy communities and for solar and wind facilities that serve low-income communities. The PTC would consist of a base credit rate of 0.5 cents per kilowatt hour and bonus credit rate of 2.5 cents per kilowatt hour through 2026.

The renewable energy investment tax credit (ITC) includes projects that begin construction before the end of 2026 and then would phase down over two years. The ITC would be expanded to include energy storage technology and linear generators. These technologies would be eligible for a 6 percent base credit rate or a 30 percent bonus credit rate. It would provide an additional 20 percent credit for the ITC if the solar facility was placed in service in connection with a qualifying low-income residential building/low-income benefit project, or an additional 10 percent credit if the facility is located in a low-income community.

The production tax credit and investment tax credit would be available after 2026 and phased out beginning in 2031 or when U.S. emissions targets are achieved.

Electric Vehicle Tax Credits

Under the Build Back Better bill a $7,500 consumer tax credit would be made refundable and expanded by $4,500 for cars assembled domestically by plants represented by unions. An additional $500 bonus would be added for vehicles that use batteries made in the United States for a total of $12,500. The legislation also would create a new $4,000 tax credit for the purchase of used electric vehicles. The new tax-credit package also eliminates the 200,000-vehicle cap, making GM and Tesla vehicles eligible again.

More expensive vehicles would not qualify for the tax credit under the current proposal. Sedans and smaller cars would only be eligible if they cost less than $55,000. For sport-utility vehicles and trucks, the sticker price would have to be under $80,000 to qualify. The proposed tax credit includes an income cap. Individuals have to make under $250,000 annually to be eligible for the credit. For households, the cap is $375,000 for a single-income family and $500,000 for a dual-income family.

The $2 trillion tax and spending bill, passed by the House, would significantly expand the nation’s demand for lithium batteries and provide opportunities for Chinese electric vehicle supply chain leaders including the Contemporary Amperex Technology Company (CATL). Based in the southeastern province of Fujian, CATL is the world’s largest manufacturer of power batteries and materials. Auto giants Daimler, BMW, and BAIC Motor Corp are customers.

Conclusion

Despite high gasoline prices stressing the U.S. consumer and home heating prices expected to soar this winter, the House Democrats are hiking fees and increasing red tape on the U.S. oil industry. The House Build Back Better bill provides oil and gas provisions that are punitive measures, including arbitrary new fees that would add millions of dollars in annual operating costs, pricing out U.S. production on federal lands and waters and taxing methane emissions from all production, even on private lands. These provisions are a gift to higher emitting producers like Russia and China that wield their energy resources as a geopolitical tool and would fundamentally weaken one of America’s most important economic, energy, emissions and national security assets. At the same time, it would give renewable technologies subsidies that they have been receiving for decades to replace efficient and affordable energy from coal, oil, natural gas and nuclear power. The result of the Build Back Better Bill is not better energy or a better life style for Americans. Rather, it is a costly measure, increasing transportation fuel, heating, and electricity bills for Americans.

*This article was adapted from content originally published by the Institute for Energy Research.

President Biden seeks further restrictions of oil and gas development on federal lands, substantially higher royalty fees.

WASHINGTON DC (November 23, 2021) – The American Energy Alliance (AEA), the country’s premier pro-consumer, pro-taxpayer, and free-market energy organization, strongly condemns President Biden’s Black Friday release of a report on the federal oil and gas leasing program calling for further restrictions on federal lands for oil and gas development.

AEA President Thomas Pyle made the following statement in response to the release of the report:

“Just days after taking to the podium to feign his concern for higher gasoline prices, President Biden’s Interior Department released a Black Friday bombshell report calling for even less drilling on federal lands and draconian increases in royalty payments. If enacted, theses policies would further limit our ability to produce oil and gas resources on federal lands and waters and lead to even greater pain at the pump.

“While Americans are enjoying their Thanksgiving holiday, despite the fact that they are paying more because of Biden’s anti-energy and inflationary policies, the Administration is attempting to bury their latest assault on the oil and gas industry with a Black Friday announcement. It’s just another example of their open disregard for the struggles of hard working American families.

“President Biden’s actions speak louder than his words. He wants American families to think he cares about high gasoline prices, yet all of his actions since day one of his presidency make it abundantly clear he wants them to soar even higher.”

Additional Resources:

For media inquiries please contact:

On this episode of The Unregulated Podcast Tom Pyle and Mike McKenna discuss the Biden administration’s decision to release resources from the U.S. Strategic Petroleum Reserve.

President Biden’s Thanksgiving Day ploy to address rising gasoline prices ignores his ten months of anti-energy policy.

WASHINGTON DC (November 23, 2021) – The American Energy Alliance (AEA), the country’s premier pro-consumer, pro-taxpayer, and free-market energy organization, dismissed President Joe Biden’s announced release of oil from the Strategic Petroleum Reserve (SPR) as a cynical and feckless exercise timed for Thanksgiving and aimed at stemming his plummeting poll numbers. A release from the SPR will do nothing to solve the root cause of American’s increased gasoline prices that he and his administration have largely contributed to since his first day in office.

AEA President Thomas Pyle made the following statement in response to the announcement:

“President Biden’s Thanksgiving feast of 50 million barrels from the Strategic Petroleum Reserve is a cynical exercise directed more to influence his falling poll numbers than actually helping bring down gas prices for hard-pressed American families. From his first day in office, President Biden has championed policies designed specifically to curtail the production and distribution of our oil resources and increase the cost of gasoline. Perhaps his release of our strategic national reserve is a sign that his policies are working too well.

“On day one, President Biden stopped thousands of Americans from working on the Keystone XL pipeline from Canada, which would have delivered long-term supplies of oil to our refineries in the Gulf of Mexico. Biden also suspended leasing on 2.46 billion acres of federal lands and waters – illegally, as it turns out – and only held the first lease sale last week under a judge’s orders.

“President Biden has presided over an energy policy that has made Russia our number two importer of oil. The Administration shut down congressionally mandated lease sales in ANWR and the National Petroleum Reserve Alaska, while Russia now supplies twice as much oil as we get from Alaska. Now, when Americans are feeling the impact of gas prices at a seven-year high, he wants more oil on the market.

“Biden’s plan ignores the fact that market analysts have already factored the release into the price of oil, meaning the savings at the pump will barely register. Meanwhile, Bank of America predicts that oil prices will reach $120 per barrel next year, when those million barrels are expected to be returned to the SPR. That’s hardly a good deal for our refiners.

“After ten months of the most extreme anti-oil and natural gas agenda ever from a sitting president, Biden’s SPR release is like raiding the pantry while starving the farmer. No thanks, Joe.”

Additional Resources:

For media inquiries please contact: