In a recent speech, former U.K. Environment Secretary Owen Paterson compared the U.K.’s Climate Change Act to the policies of the infamous Sheriff of Nottingham in the story of Robin Hood:

“It amazes me that our last three energy secretaries, Ed Miliband, Chris Huhne and Ed Davey, have merrily presided over the single most regressive policy we have seen in this country since the Sheriff of Nottingham: the coerced increase of electricity bills for people on low incomes to pay huge subsidies to wealthy landowners and rich investors.” [Emphasis added]

Paterson specifically pointed out policies that subsidize wind, which are expected to cost the U.K. 1.3 trillion euros by 2050.

The United States faces a similar problem with the decades-old wind Production Tax Credit (PTC), which provides wind producers with a subsidy from the American people of 2.3 cents per kilowatt hour. Although the wind PTC expired at the end of 2013, Congress is under pressure from the American Wind Energy Association (AWEA) and the Internal Revenue Service (IRS) to extend the tax credit via a tax extenders package (the IRS has already given wind producers very favorable treatment on existing provisions). Senate Majority Leader Harry Reid has made it clear that passing tax extenders will be a top priority going into the lame duck session.

But an extension of the PTC would not come cheap. The Senate Finance Committee estimates that a two-year extension would cost taxpayers $13.35 billion.

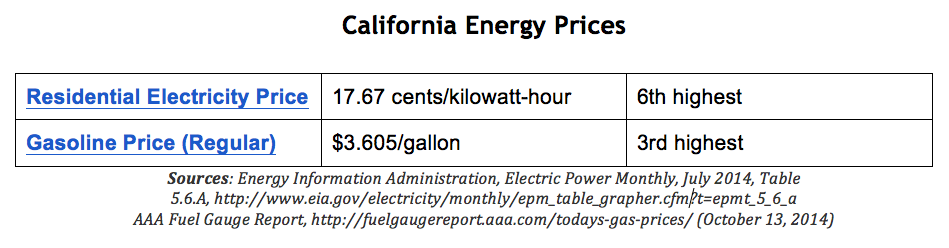

Not only do Americans pay for the wind PTC in their taxes, but also through higher energy prices, as First Energy CEO Anthony Alexander explains:

“Subsidies such as the Production Tax Credit encourage developers to build whether or not the generation output is needed. This unneeded, excess capacity is not only uneconomic, but it puts additional pressure on baseload coal and nuclear assets that are essential to grid stability and affordable energy prices.” [Emphasis added]

Just like the Sheriff of Nottingham, the PTC gives to the rich at the expense of average taxpayer. As billionaire investor and Berkshire Hathaway CEO Warren Buffett said:

“I will do anything that is basically covered by the law to reduce Berkshire’s tax rate. For example, on wind energy, we get a tax credit if we build a lot of wind farms. That’s the only reason to build them. They don’t make sense without the tax credit.”

Reinstating the PTC will only put more of a financial burden on the American people while lining the pockets of billionaires and subsidy-chasing corporations. U.S. policymakers should echo the calls of Owen Paterson in the U.K. and put an end to subsidies like the wind Production Tax Credit once and for all.