In April, Senator Debbie Stabenow (D-MI) introduced the Drive America Forward Act, a bill that would expand the tax credit for new plug-in electric vehicles (EVs) by allowing an additional 400,000 vehicles per manufacturer to be eligible for a credit of up to $7,000. Currently, the tax credit is worth up to$7,500 until a manufacturer sells more than 200,000 vehicles. In late September, groups that stand to benefit from the extension of the federal tax credits wrote to Senator McConnell and other leaders in Congress, encouraging them to support on the Drive America Forward Act. As IER has documented in the past, lawmakers should not extend the EV tax credit as the policy is unnecessary, inefficient, unpopular, costly, and unfair.

Unnecessary and inefficient

The EV tax credit is not necessary to support an electric vehicle market in the U.S. as one group estimates that 70 percent of EV owners would have purchased their vehicle without receiving a subsidy, which is reasonable seeing as 78 percent of credits go to households making more than $100,000 a year. Furthermore, the federal tax credit overlaps with a number of other government privileges for EVs, including:

- State rebates and/or other favors (reduced registration fees, carpool-lane access, etc.) in California, as well as in 44 other states and the District of Columbia.

- Tax credits for infrastructure investment, a federal program that began in 2005 and, after six extensions, expired in 2017.

- Federal R&D for “sustainable transportation,” mainly to reduce battery costs, averaging almost $700 million per year.

- Credit for EV sales for automakers to meet their corporate fuel economy (CAFE) obligations.

- Mandates in California and a dozen other states for automakers to sell Zero-Emission Vehicles—a quota in addition to subsidies.

Even if the federal tax credits were needed to support demand for EVs, the extension of the tax credit would be an absurdly inefficient means of achieving the stated goal of the policy, which is ostensibly to lower carbon emissions. The Manhattan Institute found that electric vehicles will reduce energy-related U.S. carbon dioxide emissions by less than 1 percent by 2050.

Unpopular

Lawmakers should be aware that the vast majority of people do not support subsidizing electric vehicle purchases. The American Energy Alliance recently released the results of surveys that examine the sentiments of likely voters about tax credits for electric vehicles. The surveys were administered to 800 likely voters statewide in each of three states (ME, MI and ND). The margin of error for the results in each state is 3.5 percent.

The findings include:

- Voters don’t think they should pay for other people’s car purchases. In every state, overwhelming majorities (70 percent or more) said that while electric cars might be a good choice for some, those purchases should not be paid for by other consumers.

- As always, few voters (less than 1/5 in all three states) trust the federal government to make decisions about what kinds of cars should be subsidized or mandated.

- Voters’ sentiments about paying for others’ electric vehicles are especially sharp when they learn that those who purchase electric vehicles are, for the most part, wealthy and/or from California.

- There is almost no willingness to pay for electric vehicle car purchases. When asked how much they would be willing to pay each year to support the purchase of electric vehicles by other consumers, the most popular answer in each state (by 70 percent or more) was “nothing.”

The full details of the survey can be found here.

Costly and unfair

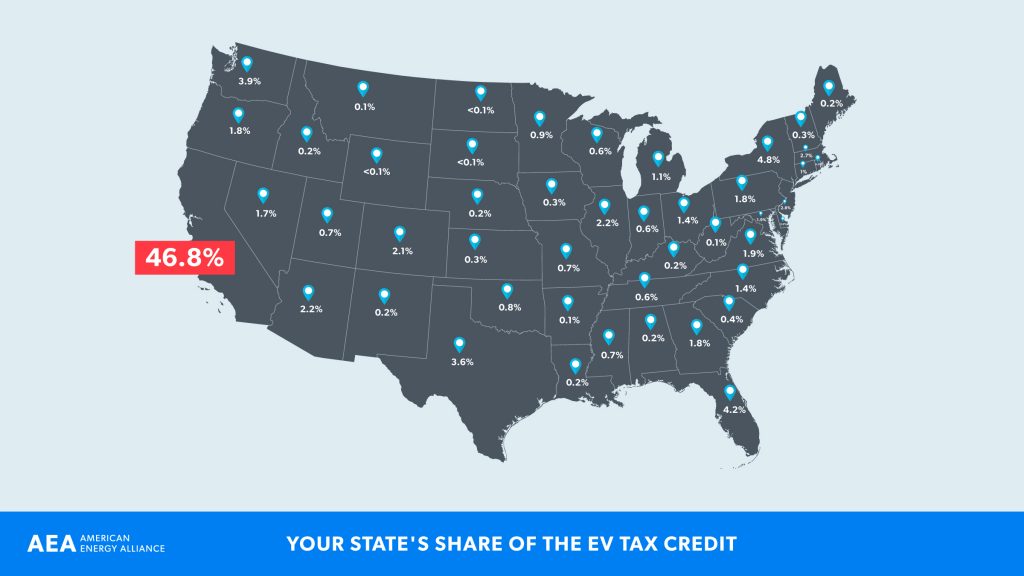

Most importantly, an extension of the federal EV tax credit is unfair as the policy concentrates and directs benefits to wealthy individuals that are predominantly located in one geographic area, namely California. A breakdown of each state’s share of the EV tax credit is displayed in the map below:

In 2018, over 46 percent of new electric vehicle sales were made in California alone. Given that California represents only about 12 percent of the U.S. car market, this disparity means that the other 49 states are subsidizing expensive cars for Californians. However, in order to understand the full extent of the benefits that people in California are receiving, some further explanation is in order.

When governments enact tax credit programs that favor special businesses without reducing spending, the overall impact is parallel to a direct subsidy as the costs of covering the tax liability shift to the American taxpayer or are subsumed in the national debt (future taxpayers). California offers a number of additional incentives on top of the federal tax credit for electric vehicles that are also driving demand for EVs in the state. These incentives include an additional purchase rebate of up to $7,000 through the Clean Vehicle Rebate Project, privileged access to high-occupancy vehicle lanes, and significant public spending on the infrastructure needed to support EVs. Therefore, the additional incentives that California (and other states) offer to promote EVs have broader impacts as these policies incentivize more people to make use of the federal tax credit, passing their costs on to American taxpayers. In other words, you’re not avoiding the costs of California’s EV policies by not living in California.

This problem is made even worse when we consider the impact of zero-emission vehicle (ZEV) regulations, which require manufacturers to offer for sale specific numbers of zero-emission vehicles. As recently as 2017, auto producers have been producing EVs at a loss in order to meet these standards, and they have been passing the costs on to their other consumers. This was made apparent in 2015 by Bob Lutz, the former Executive Vice President of Chrysler and former Vice-Chairman of GM, said:

“I don’t know if anybody noticed, but full-size sport-utilities used to be — just a few years ago used to be $42,000, all in, fully equipped. You can’t touch a Chevy Tahoe for under about $65,000 now. Yukons are in the $70,000. The Escalade comfortably hits $100,000. Three or four years ago they were about $60,000. What this is, is companies trying to recover what they’re losing at the other end with what I call compliance vehicles, which are Chevy Volts, Bolts, plug-in Cadillacs and fuel cell vehicles.”

Fiat Chrysler paid $600 million for ZEV compliance credits in 2015 (plus an unknown amount of losses on their EV sales), and sold 2.2 million vehicles, indicating Fiat Chrysler internal combustion engine (ICE) buyers paid a hidden tax of approximately $272 per vehicle to subsidize wealthy EV byers. ICE buyers were 99.3 percent of U.S. vehicle purchases in 2015. So, even if half the credits purchased were for hybrids, each EV sold in 2015 was subsidized by more than $13,000 in ZEV credit sales, in addition to all of the other federal, state, and local subsidies.

As is typical with most policies that benefit a politically privileged group, the plan to extend the federal tax credit program comes with tremendous costs, which are likely being compounded by people abusing the policy. One estimate found that the overall costs of the Drive America Forward Act would be roughly $15.7 billion over 10 years and would range from $23,000 to $33,900 for each additional EV purchase under the expanded tax credit. Seeing as the costs of monitoring and enforcing the eligibility requirements of the EV tax credit program are not zero, it should surprise no one that the program has been abused as it has recently come to light that thousands of auto buyers may have improperly claimed more than $70 million in tax credits for purchases of new plug-in EVs. Finally, additional concerns arise over the equity of the federal EV tax credit due to the fact that half of EV tax credits are claimed by corporations, not individuals.

End this charade

When the tax credit was first adopted, politicians assured us that the purpose of the program was to help launch the EV market in the U.S. and that the tax credit would remain capped at the current limit of 200,000 vehicles. At that time, we warned that once this program was in place, politicians would continue to extend the cap in order to appease the demands of manufacturers and other political constituencies that were created by the program. A decade later, we find ourselves in that exact situation. At this point, it should be clear that Congress should not expand the federal EV tax credit as the program is nothing more than an extension of special privileges to wealthy individuals and corporations that are mostly located in California. If Congress can’t find the courage to put an end to such an unfair and inefficient policy, President Trump should not hesitate to veto any legislation that extends the federal EV tax credit, as doing so would be consistent with his approach to other energy issues such as CAFE reform.