California’s declining oil production and refinery closures, caused by the state’s energy policies, could create an “aviation fuel crisis.” An increasing dependence on imported aviation fuel could threaten national security. Several U.S. military installations, including Travis Air Force Base and Naval Air Weapons Station China Lake, rely almost entirely on California refineries for their jet fuel. According to the Energy Information Administration, California ranks first in jet fuel demand among the states. Via AVWeb, California imports approximately one million barrels of oil per day, with about 20% of its jet fuel, gasoline, and diesel coming from India. India has been obtaining about 40% of its oil from Russia, though it is winding down those imports due to additional sanctions on Russia for its invasion of Ukraine and Trump’s 50% tariffs on its goods.

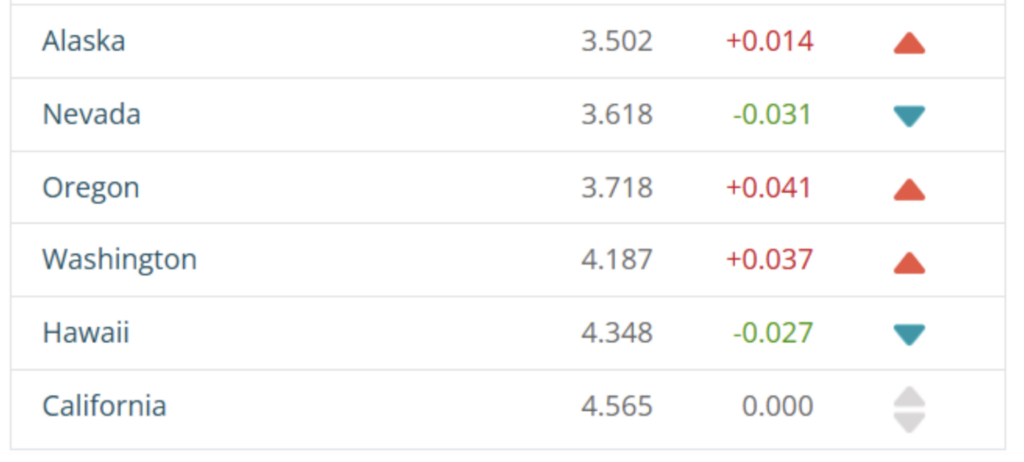

California had more than 40 refineries in 1991, but only eight remain as of October 2025. The lack of refineries and the unique nature of California’s gasoline blend are causes for California’s gasoline prices to be over $1.60 higher than the nation’s average price. According to PennyGem, with the closure of Valero’s refinery in Benicia in the spring of 2026, California will lose 145,000 barrels of gasoline and diesel daily — about 8% of the state’s refining capacity. California’s gasoline prices are expected to increase by 15 cents per gallon, with possible spikes above $7 or $8 per gallon. The loss of 2.2 billion gallons annually affects not only personal vehicles, but also shipping routes, aviation, and emergency services. California Governor Gavin Newsom and the state’s lawmakers are reviewing emergency measures, including infrastructure upgrades and strategic fuel reserves, but admit that such efforts may not avert near-term consequences of the closure stemming from the state’s regulations.

Via PennyGem, California’s unique fuel standards and pipeline limitations mean replacement barrels must come from overseas — primarily Asia and the Middle East — at higher costs and longer transit times. Other U.S. refineries do not make the fuels required by the state, resulting in imports of the refined products in tankers crossing the Pacific. California believes that its onerous regulations and higher resulting petroleum prices would make consumers move more quickly to electric vehicles and solar and wind power. The state’s 27 million licensed drivers, however, still rely heavily on gasoline. While some consumers are switching to electric vehicles, that transition is slower than the closure of the state’s refineries and the availability of domestically produced petroleum products.

Background

California’s oil refiners are confronting mounting regulatory and cost pressures as the state races toward its ambitious climate goals. A suite of new emissions targets, rules on gasoline-vehicle sales, and tougher transparency mandates has reshaped the business landscape — prompting Phillips 66, for example, to announce the closure of its Los Angeles refinery after lawmakers required facilities to keep larger fuel stockpiles to prevent price spikes.

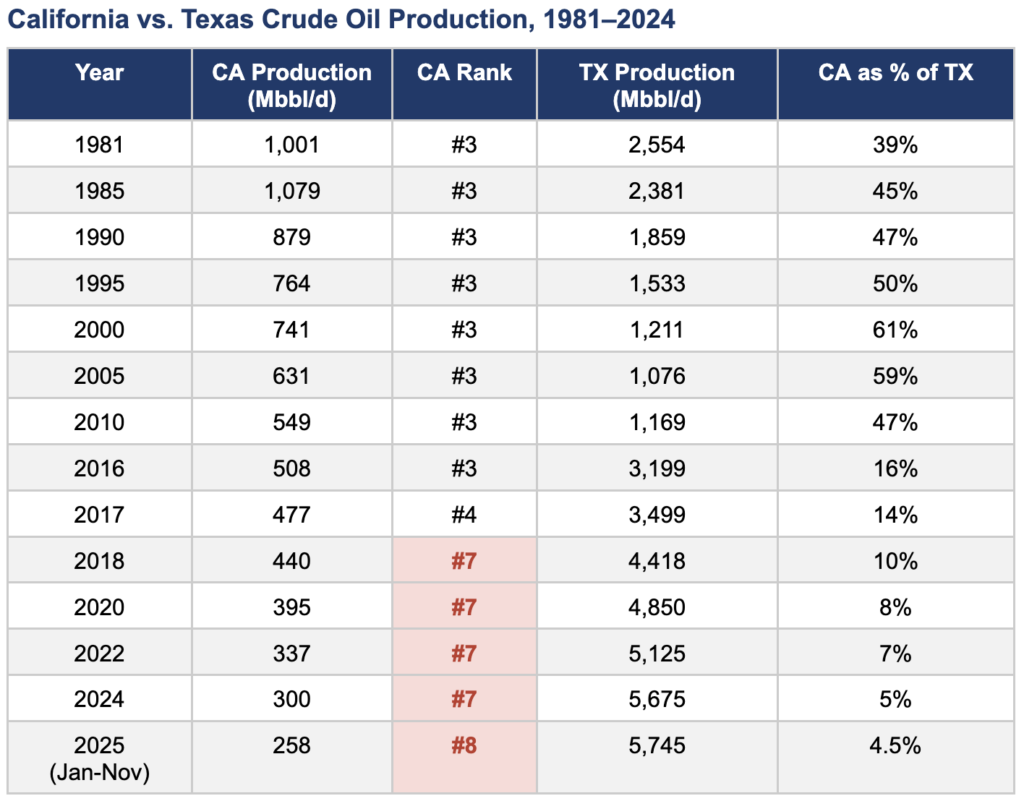

The regulatory squeeze comes as California’s own oil output has been in long-term decline. Production has fallen for most of the past four decades, even as states like Texas and New Mexico have surged ahead. Since taking office, Governor Gavin Newsom has layered on additional restrictions, including measures to phase out fossil fuels from both production and consumption. He has pushed for a ban on the sale of new gasoline-powered cars by 2035 and, in 2022, signed a law prohibiting oil and gas drilling within 3,200 feet of homes, schools, hospitals, and other buildings — despite the fact that many of those structures were built decades after nearby oil operations began.

That same year, state regulators adopted a sweeping climate plan to slash carbon dioxide emissions by 85% below 1990 levels by 2045. The blueprint includes cutting oil and gas consumption to less than one-tenth of today’s levels, a target that further clouds the investment outlook for refineries already weighing whether to upgrade, convert, or shut down.

Newsom has also taken an increasingly confrontational stance toward the industry. In September 2023, his administration filed a lawsuit accusing oil companies of misleading the public about climate change for decades. He later signed legislation enabling the state to pursue refiners for alleged price gouging. Under SB X1-2, the California Energy Commission can set a maximum profit margin for in-state refiners and penalize companies that exceed it. Another bill, AB X2-1, expands reporting and disclosure requirements across the refining sector.

Together, the policies signal a state determined to accelerate its energy transition — even as they raise questions about the future of California’s remaining refining capacity.

Analysis

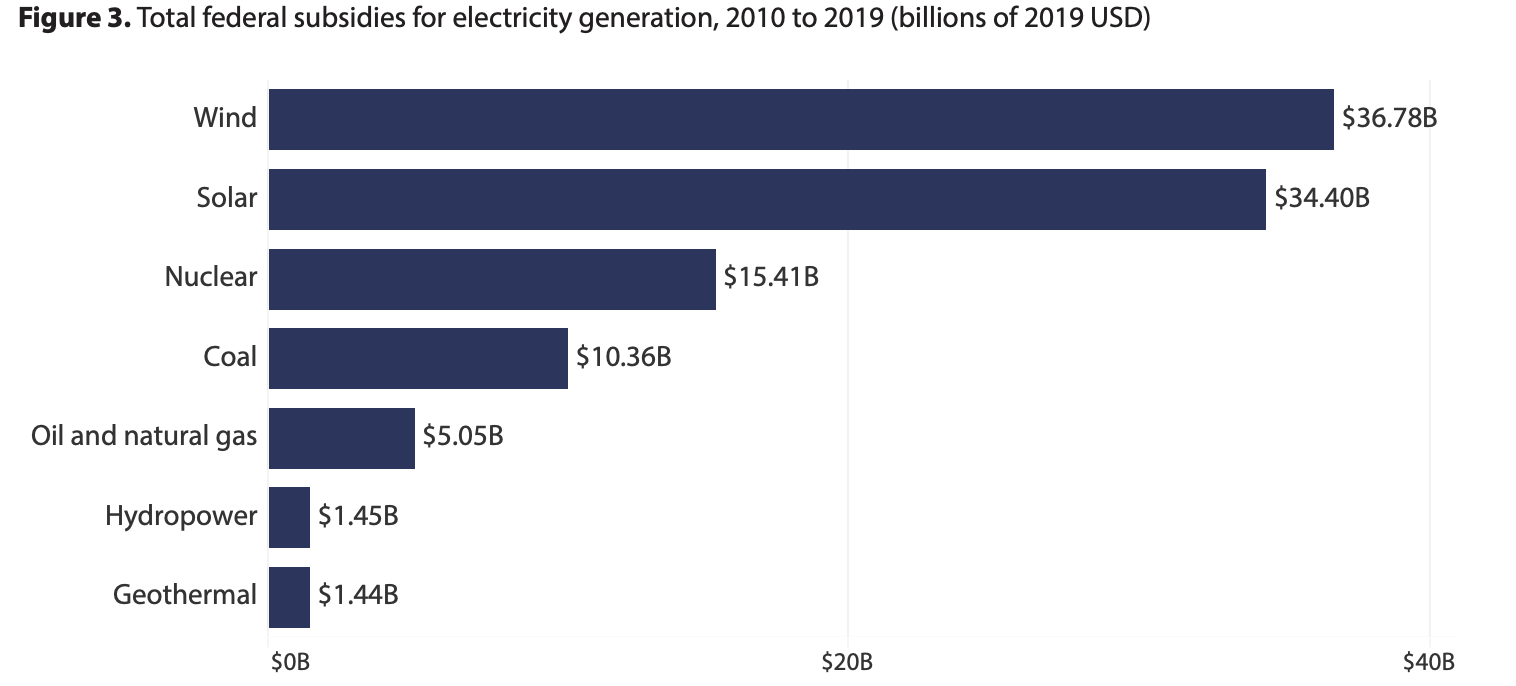

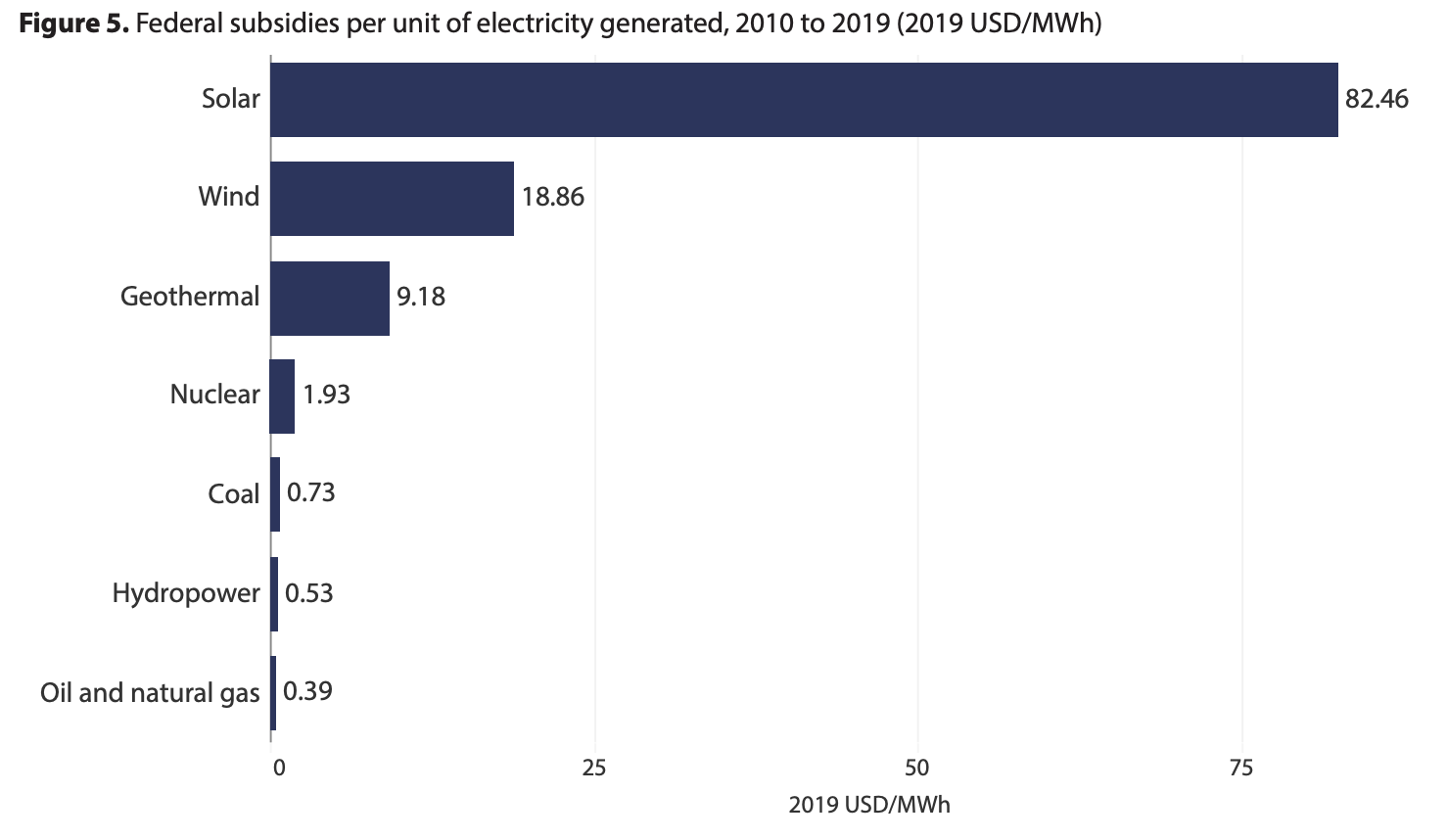

Refiners cannot survive in California with Governor Newsom’s policies against oil companies and their oil and gasoline production, threatening the state’s aviation fuel supply. These refinery closures are a response to policy actions by California, including a goal of reducing gasoline use to one-tenth its current consumption by 2045. Governor Newsom’s recently proposed Sustainable Aviation Fuel Tax Credit will do little to better the situation. A better approach involves allowing refiners to determine the amount and type of fuel they produce without overburdening regulations or subsidies. As we’ve written previously, “California’s history of progressive legislation favoring renewable energy is a clear example of the risks of government market intervention in determining winners and losers in business. Had renewable energy been required to compete on equal terms with conventional fuels, the free market would have responded accordingly, with either outright rejection or specific feedback on the innovations needed to make the technology viable for consumers.”