The barrage of criticism targeting the Renewable Fuel Standard is showing no signs of stopping. Just last week, the The New York Times and The Wall Street Journal took aim at the costly and flawed federal biofuel mandate.

Now, on the heels of the recent Iowa Ag Summit, where numerous prominent Republican presidential candidates kowtowed to the powerful ethanol lobby, USA Today has weighed in on the government’s ethanol directive. Their take? End the ethanol mandate. Here’s an excerpt from the piece:

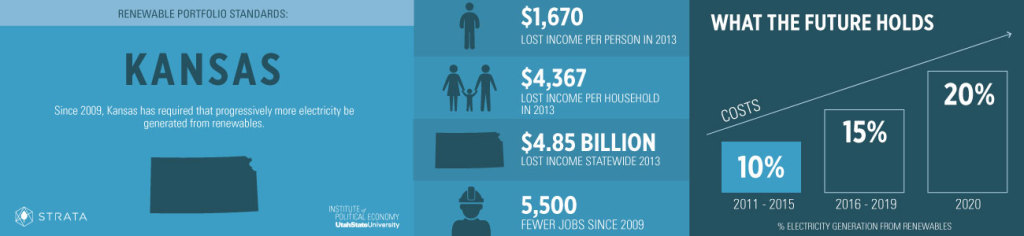

The RFS, which requires retailers to sell a 10% ethanol blend or pay into a convoluted subsidy system, imposes major burdens on consumers. A gallon of ethanol is more expensive than a gallon of gasoline ($2.43 vs. $1.73 wholesale) and gets only about two-thirds the mileage.

This forces motorists to pay $10 billion a year more at the pump, according to Robert Bryce of the Manhattan Institute. That’s more than a quarter of the $38 billion raised by the federal gasoline tax. Then consumers get hit a second time at the supermarket, where rising corn prices drive up the cost of everything from beef to cereal.

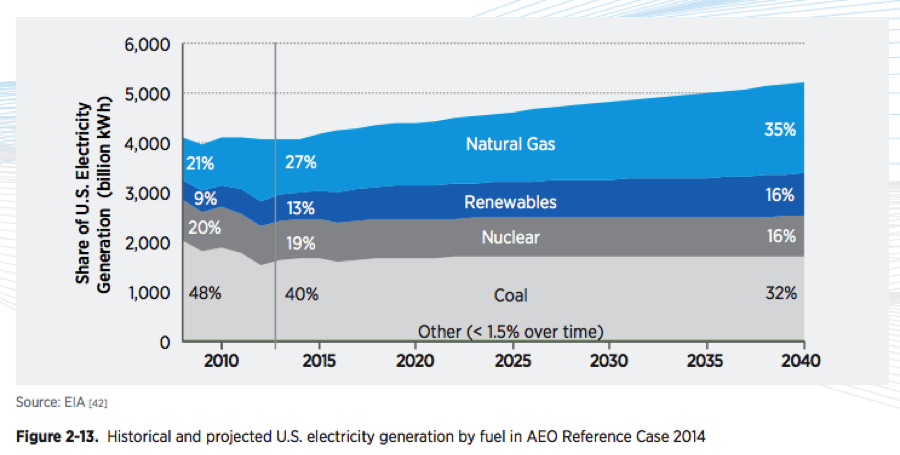

Meanwhile, the argument that energy security demands a home-grown, “renewable” fuel is no longer viable thanks to new oil and gas drilling techniques and advances in wind and solar. In fact, the ethanol makers who once wrapped themselves in the flag are now shipping their product overseas.

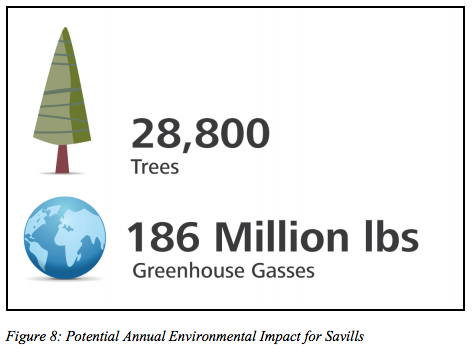

Another rational — ethanol’s status as a “clean” fuel — was always a farce. While a gallon of ethanol emits fewer greenhouse gases than a gallon of gasoline, it is far dirtier after accounting for the energy used to till and fertilize the land used to produce it.

If these weren’t enough reasons to revisit the mandate, consider this: Fuel use has been dropping thanks to more efficient cars and other factors. That has made it hard to unload mandated ethanol quotas without going above a 10% blend, something Detroit says its cars can’t handle.

The solution is obvious: Just end the mandate — notwithstanding the kowtowing of politicians traipsing through Iowa.

You can read the rest of USA Today’s editorial here.