Congress may soon consider legislation retroactively extending a raft of expired tax subsidies, known as “tax extenders.” One of those is the wind Production Tax Credit, a multi-billion dollar tax credit that subsidizes wind developers for the electricity they generate. This costly handout raises energy prices, destabilizes the electric grid, and benefits wealthy wind lobbyists at the expense of American taxpayers.

The rest of the developed world has learned this lesson the hard way: decades of wind energy subsidies have wreaked havoc on the economies and budgets of Australia and several European countries. Some of these countries have seen the error of their ways and are now curtailing subsidies. This month, Australia Prime Minister Tony Abbott announced that “mature technologies like wind” will no longer qualify for renewable energy subsidies.

As Congress debates tax extenders, lawmakers should learn from Australia’s and Europe’s failed wind subsidy experiment and reject any attempt to revive the wind PTC.

Background

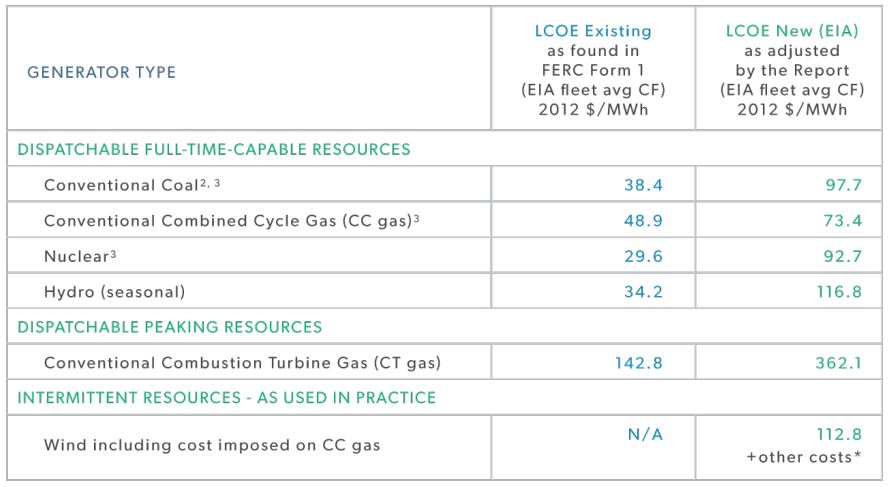

Wind energy is an old, mature technology. It is much older than most people realize: people have used wind power to generate electricity since at least 1887. Despite the wind lobby’s claims, wind power is more expensive and less reliable than traditional energy sources: a new report from the Institute for Energy Research shows that new wind facilities are three times more expensive than existing coal and four times more costly than existing nuclear power plants. This helps explain why governments in the United States and Europe have continually relied on subsidies to prop up their wind industries at the expense of taxpayers and more affordable energy sources.

Even the European Union, which has been dealing with the self-inflicted wounds of subsidized wind for decades, agrees that wind is a “mature” industry. Last year, EU Climate Action Commissioner Connie Hedegaard said “my view is that if you have mature technologies, renewables or not, they should not have state aid. If they can manage themselves why have state aid?” In other words, mature industries like wind power should not require government subsidies to survive.

In the United States, wind energy has received $30 billion in federal subsidies and grants over the last three decades while supplying less than 5 percent of U.S. electricity, according to a report from the Mercatus Center. The wind PTC is one of the most costly federal subsidies for wind power—the one-year extension Congress passed last year will cost $6.4 billion over the next decade. First enacted in 1992, the PTC was meant as a temporary means of propelling the wind industry to make wind competitive with other electricity sources. In 2003, Sen. Chuck Grassley, author of the PTC, said wind would only need the PTC “maybe for 10 years.” Twelve years later, Grassley and the wind industry are asking Congress for yet another PTC extension.

Europe’s wind subsidies are even more expensive and extensive than ours. Countries across the EU—including the United Kingdom, Germany, Spain, and Italy—have worked for decades to promote wind energy and were once proud of their record as “green energy” champions. Recently, many Europeans are having buyer’s remorse. Faced with runaway costs, stagnant economies, and destabilized electric grids, Europe is freezing, trimming, and repealing many of its subsidies and mandates. Outside of Europe, the Australian government recently announced that “mature technologies like wind” will no longer qualify for renewable energy subsidies.

President Obama has hailed Europe as a model for a renewable energy future. Instead, wind subsidies should be cut to lower energy prices and ease the economic burden placed on families. A good place to start is for Congress to let the PTC remain expired.

Below are a few examples from Europe and Australia that demonstrate the damaging effects of wind power subsidies.

United Kingdom

Although the United Kingdom is one of the leading countries in subsidized wind energy production, the government has decided to cut back on its wind subsidies. Last month, the government announced a key subsidy scheme, the Renewables Obligation (RO), will be closed a year earlier than planned in the hopes of bringing down high electricity costs and protecting the “beautiful countryside of the United Kingdom” from wind turbines. Last year, $1.3 billion of government subsidies propped up onshore wind that generated only five percent of Britain’s total electricity supply. (The UK heavily subsidizes offshore wind, and the government is being criticized for “needlessly high energy bill levies.”)

The cost of subsidizing new wind facilities in the United Kingdom is spiraling out of control and crippling an already stagnant economy. These green energy schemes will require 9 billion pounds ($14 billion) a year in subsidies by 2020 and will cost households about 170 pounds ($265) annually by the end of the decade. The UK’s subsidy problem has been described as creating a “black hole in [the] budget.” These staggering costs have prompted over 100 Members of Parliament from across the political spectrum to request that Prime Minister David Cameron rethink the government’s support for on-shore wind energy production.

The U.K is also concerned about losing businesses to countries where energy costs are lower. According to Chancellor of the Exchequer George Osborne, “if we burden [British businesses] with endless social and environmental goals—however worthy in their own right—then not only will we not achieve those goals, but the businesses will fail, jobs will be lost, and our country will be poorer.”

Despite the looming UN climate talks in Paris, the UK is taking steps to cut back on expensive renewable energy policies in the hope of easing the economic burden they have placed on energy consumers throughout the country.

Germany

Germany passed its first renewable law in 1991 and has since spent $440 billion on its “energy transition.” Germany’s costly energy crusade has raised renewable production from 4.3 percent in 1990 to almost 24 percent in 2012 with the goal of reaching 80 percent of total energy production by 2050. Germany has paid for this ambitious plan through taxes and dramatically higher energy prices. Today, electricity rates in Germany are about 30 U.S. cents a kilowatt hour compared to an average of less than 13 cents a kilowatt hour in the U.S.

The devastating effects of these subsidies have rippled throughout Germany’s economy, resulting in a flight of German companies overseas where energy costs are lower. According to a report from IER, Germany’s renewable energy subsidies are driving up energy prices and forcing hundreds of thousands of people into energy poverty. The study found:

- Residential German electricity prices are nearly three times higher than electricity prices in the U.S. and among the highest in the industrialized world.

- As many as 800,000 Germans have had their power cut off because of an inability to pay for rising energy costs.

- On-shore wind has required feed-in tariffs that are in excess of 300 percent higher than market prices.

- Germany’s Renewable Energy Levy, which subsidizes renewable energy production, cost German households €7.2 billion ($9.6 billion) in 2013.

- The cost to expand transmission networks to integrate renewables stands at $33.6 billion, which grid operators say accounts “for only a fraction of the cost of the energy transition.”

Germany’s green energy experiment has not only cost families and businesses, but it has also failed to reduce greenhouse gas emissions —the entire point of subsidizing low-carbon energy sources. As IER’s report explained, after the Fukushima nuclear disaster the German government hastily scaled back nuclear energy development. Since wind and solar are too scarce and intermittent to fill in the gap, coal stepped up to replace the lost nuclear output. This central planning has resulted in higher greenhouse gas emissions even as the government pours subsidies into renewables at huge expense to German families.

Unsurprisingly, this economic burden, in the midst of an already tight economy, has led the German government to re-evaluate their costly policies. The Commission for Research and Innovation, a group of experts appointed by the German parliament, found that Germany’s subsidies have not had a positive effect on the environment or innovation, and has recommended that they be abolished.

Spain

Once hailed by President Obama as a poster-child for green energy development, Spain has been forced to rethink green energy subsidies. In 1994, Spain implemented feed-in-tariffs to help bolster their renewable industry and help renewables like wind and solar penetrate the energy market. Now, realizing the economic burdens of these inefficient policies, Spain has capped green companies’ profits at a 7.4 percent return, while eliminating all subsidies to wind projects built before 2005.

According to Industry Minister Jose Manuel Soria, these renewable energy subsidies or the power system would have gone bankrupt. Spain had already paid about 56 billion euros ($76.5 billion) to clean energy generators since 1998 and will pay another 142 billion euros over their lifetimes. In 2013 alone, subsidies totaled 9 billion euros. The costs of these subsidies put further burdens on the country as Spain took on huge amounts of energy debt to fund their policies, cumulatively reaching $35 billion in 2013.

Spaniards have suffered greatly under the government’s subsidy scheme. The country has chronically stagnant economic growth, high unemployment (23 percent), and expensive electricity. Indeed, a study conducted by Dr. Gabriel Calzada found that Spain’s subsidies destroyed 2 jobs for every 1 job created. This is because subsidies do not create wealth on net. By shifting resources from the most economical to most politically favored, subsidies destroy more jobs than they create.

Now, the Spanish government has joined the ranks of its European neighbors in working to reverse these detrimental subsidy policies. The country has now ended subsidies to nearly 40 percent of its wind energy capacity in the hope that lowered electricity costs will ease the burden placed on consumers and fuel economic growth.

Italy

Italy pursued similar wind-promoting policies in the form of a feed-in-tariff and ultimately came to the same conclusions found by European neighbors: wind and other green-energy subsidies are too costly and deter growth. According to Carlo Stagnaro, a senior fellow at a Milan-based think tank, as “subsidies were added to subsidies were added to subsidies,” Italy saw electricity prices skyrocket, causing them to soar to 35 percent above the EU average, which is already more than double the U.S. average.

As a result, Federica Guidi, Italy’s minister for economic development, promoted a reform package last year that reduced the amount of subsidies by about 1.6 billion euros per year (about ten percent of the overall subsidy bill) with the goal of lowering electricity prices for consumers. Although there is continued pressure from interest groups for continued support of green energy technologies, Italy is cutting back on subsidies to spare consumers.

Australia

Outside of Europe, Prime Minister Tony Abbott is making headlines in Australia as his government has recently banned its renewable energy fund from investing in “mature technologies like wind” energy. Abbott has said that the government’s policy is to eventually abolish the fund altogether.

Abbott’s hope is that by ending costly subsidies to the wind industry, Australia’s energy sector will become more economical. “We want to keep power prices as low as possible,” the prime minister said. As in Europe, green-energy subsidies have resulted in an upward trend in energy prices in the country, primarily borne by consumers. According to the Australian Financial Review, in many states wind facilities require three times the price at which Australian coal generators can supply electricity.

The Australian government’s order to the renewable energy fund is just another step in Abbott’s drive to put an end to damaging wind energy subsidies. Additionally, in the face of upcoming UN climate talks, Abbott has shown limited enthusiasm to join the U.S. and EU, as he has become increasingly aware of the economic consequences of doing so.

Lessons for America

As Congress considers yet another PTC extension, the United States should learn from Europe’s failed subsidy experiment. Wind subsidies like the PTC have the dual problem of driving up energy costs for families while burdening taxpayers with the bill. But while Europe and Australia begin to recognize the error of their ways, the president and some in Congress continue to push for perpetual subsidies for the large, mature wind industry.

If lawmakers want to protect their constituents from higher electricity costs, lost jobs, and sluggish economic growth, then they should follow Europe’s and Australia’s lead and eliminate wind energy subsidies–especially the PTC.